Why the US Housing Market hasn't Crashed yet (repeat of 2008?)

We're now over one year into a US Housing Downturn that started in the middle of 2022, when a combination of sky-high prices, rising interest rates, and an economic slowdown triggered a massive collapse in homebuyer demand that is still ongoing in the middle of 2023.

But despite this collapse in buyer demand, home prices have remained resilient, only declining by 1% YoY on a national basis, and up to 15% in the hardest hit markets. To date, the decline in the Housing Market registers more as a modest correction rather than a crash.

This slow pace of initial price declines is now leading many homebuyers and real estate investors to believe that the Housing Market won't ever crash, and that we'll be stuck with high prices into the foreseeable future.

Is this true? Well, let's look into the data, step by step, so you as a homebuyer or investor can uncover truth about when this Housing Market will crash.

1) Home Prices in America are 30% overvalued in 2023

One of the first things that's important to understand is just how high home prices are in America in 2023 compared to the long-term history of the US Housing Market. Particularly, in how home prices compare to fundamentals such as income, rent, and inflation.

Data from the US Census Bureau and Zillow highlights that the Home Price to Income Ratio in America is currently trading at 4.40x. That's near the highest level on record and is 31% above the long-term norms going back to 1970, implying that US Housing Market is 31% overvalued relative to income.

In addition - home prices are also overvalued relative to inflation, with the Case Shiller Inflation-Adjusted Price Index registering 185 in the spring of 2023. That's 36% higher than the long-run average of 119.

Statistics which indicate that there is massive downside for homebuyers and real estate investors in the 2023 Housing Market. In fact, the bubble that still exists today is even bigger than the one in the mid-2000s relative to the fundamentals.

2) Home Prices have Started to Come Down

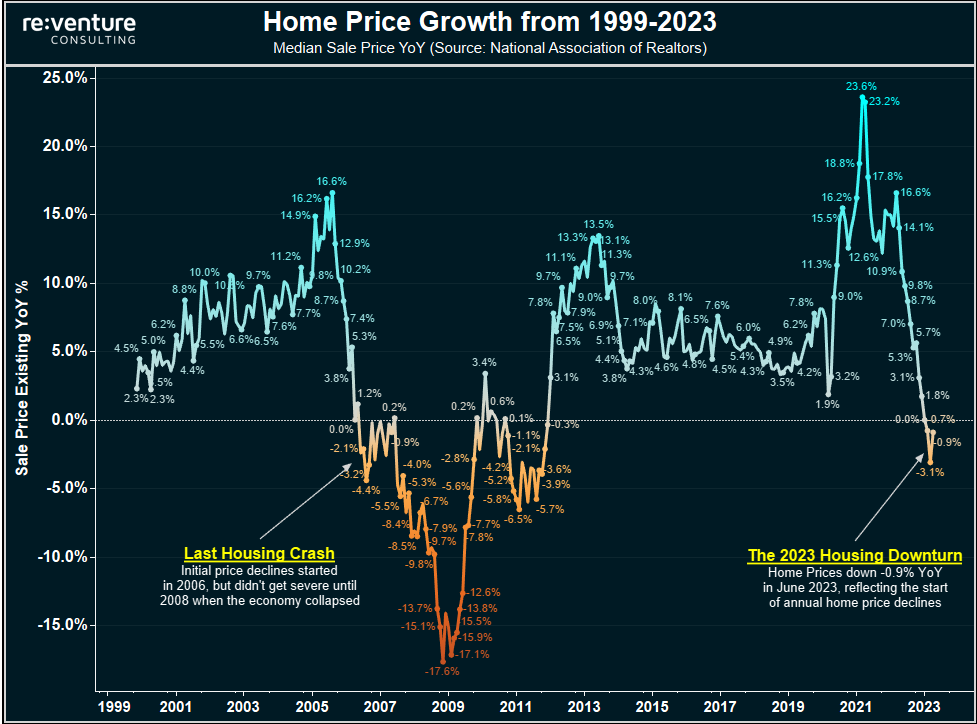

Now - these sky-high home prices levels have started to come down, just barely, with data from the National Association of Realtors showing a near 1.0% YoY decline in the Median Sale Price of Homes.

This modest decline is convincing many that the Housing Downturn isn't real, and that a crash will never happen. However, it's important to note that a similar situation occurred at the beginning of the last Housing Crash, where prices declined marginally in 2006, and then even rebounded slightly in 2007, before hitting a complete collapse by the middle of 2008.

The lesson to understand here is that the slow pace of the initial declines in this housing downturn is not proof that there isn't a downturn or that there won't be one. In fact, it's normal behavior for the beginning of a housing correction.

3) Record low inventory is putting a floor on Home Prices

One aspect of 2023 that is different from 2007 or 2008 is the inventory levels. Today, for sale inventory registers at close to the lowest level of all-time, while back in the mid-2000s inventory had already begun surging.

More specifically - the inventory of single-family homes for sale in 2023 is down 50% from its long-term norms:

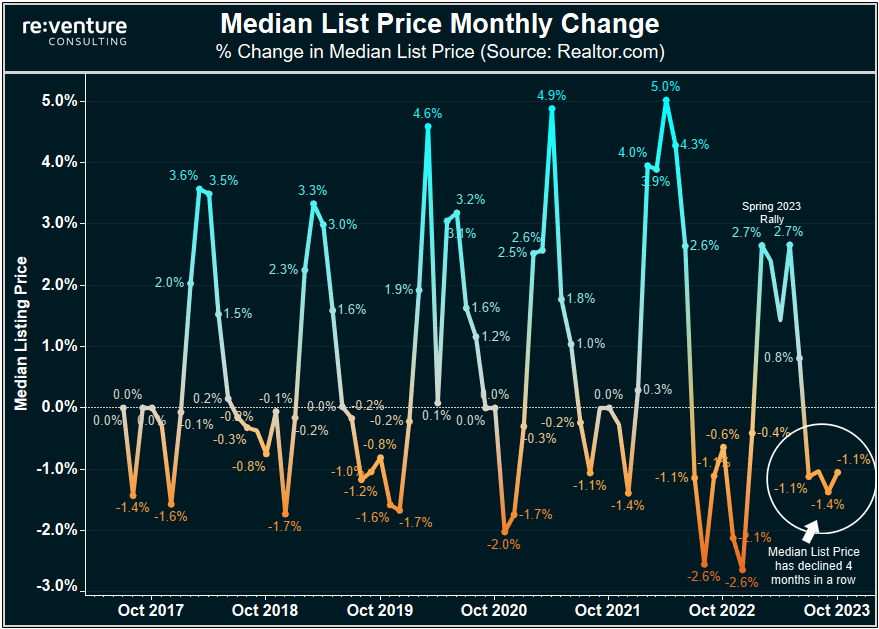

These record-low inventory levels are now putting a floor on home prices in 2023, and even resulted in a rebound in home prices this spring. You can see in the graph below that the Median Sale Price over the last several months has leapt up.

But again - context is important here. You can see looking back at this data from the NAR that home prices always go up in the spring each year, even in the beginning stages of the last downturn in 2007 and 2008.

So again - prices going up in the spring, which is resulting the modest YoY declines we're seeing today, is not evidence that there is no housing downturn or that there won't be one. It simply reflects the normal functioning of the US Housing Market.

4) Why is For Sale Inventory so low?

In order to see the type of cascading price declines we saw in 2008 and 2009, which will bring homebuyer affordability back into balance, we will need to see inventory increase from current levels.

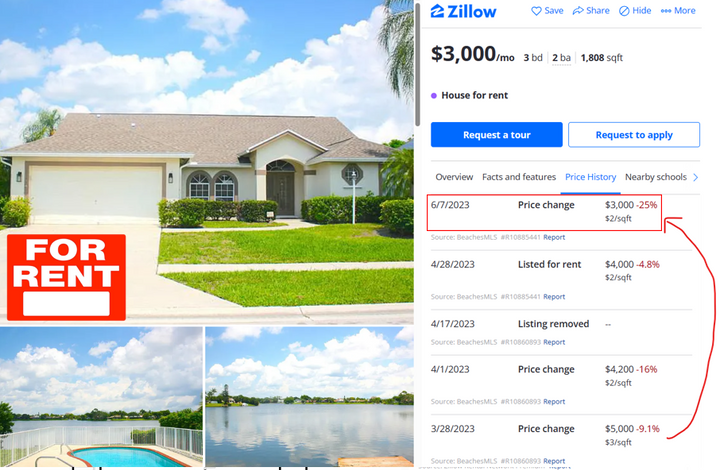

And in order for inventory to increase, more sellers will need to come to market with new listings. But thus far in 2023, the opposite has been happening, with data from Redfin showing that new seller listings are down 25% YoY.

These massive declines in new listings, which are being caused by a combination of low mortgage rates for existing owners, a low mortgage default rate, and fear about keeping money in banks, is offsetting the huge drop in homebuyer demand. And resulting in a housing market that is essentially "frozen".

You can see the frozen nature of this market by looking at the level of Existing Home Sales, which just dropped to a 14-year low of 4.16 million on a seasonally-adjusted, annualized basis according to the NAR.

This is an important graph to understand as a homebuyer or investor, because it underscores the fact that demand in the market is still in the tank. And that the only reason there is a perception of strong demand in certain areas is because the new listings are so low.

5) Do all the 3% Mortgages mean that listings will never increase?

And some people are now thinking that new listings, and inventory by extension, will never increase. With the argument being that because so many existing homeowners have a low mortgage, in some cases a sub-3% mortgage rate, that they will never sell.

And sure enough - there are a decent amount of sub-3% mortgages in the US Housing Market right now, with data from the FHFA showing that 23% of all mortgage holders have a rate below 3%.

This compares to only 9% of mortgage holders that have a rate of over 6%. Suggesting that the Housing Market will remain frozen until we see those blue and red lines on the graph above converge.

However, a different way to look at this data is by comparing it to the total amount of houses on the US Housing Market, rather than just the total amount of mortgages. For instance, there are 97 million owned housing units in America in 2023 according to data I put together from the US Census Bureau.

Of those 97 million owned units, 85 million are occupied (88%), while 12 million are vacant (12%).

Going further, roughly 59 million of those owned housing units have a mortgage (61%), compared to 38 million with no mortgage (39%).

Digging in deeper - we can see those homeowners with a sub-3% mortgage rate total about 14 million, which is 14% of all the homes in America (compared to 23% of all the mortgages).

Meanwhile, only 614k houses are listed for sale according to Realtor.com, representing 0.6% of all the houses.

Doing this analysis reveals a slightly different outcome, where it's evident that the primary reason why inventory is low is not because of homeowners with sub-3% mortgages. Rather, it's because the homeowners without a mortgage (38 million), and who have vacant properties (12 million), do not feel inclined to sell right now.

Why don't they feel inclined to sell? A variety of factors. On one hand, distress levels in the US economy still remain fairly low with the unemployment rate hovering at 3.6%, meaning that investors, Airbnb operators, and mortgaged owners do not feel immediate financial pressure to sell in most cases.

Moreover, the problems in the US Banking Sector that occurred earlier this year likely caused many would-be sellers to hold off from selling, because they didn't necessarily want to put their money in a bank.

So for now, listings and inventory are low.

6) But watch for distress to build in 2023 and 2024. Particularly among pandemic homebuyers and investors.

And so long as the unemployment remains near record lows, we're unlikely to see a burst of new listings. However, I suspect the economy will continue to deteriorate at a slow pace throughout the second half of this year, which will likely put pressure on more owners to sell.

Particularly owners who purchased in the last several years with a mortgage. Because many of these owners are struggling to make their payments and are what we would describe as "house poor". People who took out a lot of debt to buy and are stretched very thin.

We know this because data from the FHFA (the organization that runs Fannie Mae) shows that the Debt-to-Income Ratio for homebuyers has surged up to near the highest levels of all time. Specifically, the DTI Ratio in the beginning of 2023 is now approaching 40%.

Meaning that homebuyers in today's housing market are spending 40% of their gross income on their mortgage interest and debt costs. Which is comparable to what they were spending in the mid-2000s at the peak of the last Housing Bubble when it is generally accepted that "bad mortgages" perpetuated a downturn.

Now - I'm not saying we will see the same level of mortgage distress and foreclosures as back then. However, what I am saying is that under the surface there are many homeowners who are very stretched on their ability to make payments. And who are staying afloat because the unemployment rate is low, and maybe they're taking out additional debt in other forms to sustain their spending.

As the economy worsens, it's likely that more and more these stressed homeowners will be put into a situation where they will have liquidity needs and be forced to sell. Maybe on their own volition, or maybe through a mortgage default and foreclosure.

7) What should you do as a homebuyer or investor in 2023?

So - after all of that - what should you do as a homebuyer or investor in today's housing market? Especially someone who has been on the sidelines for several years waiting to buy.

Well, that's a very personal question, and really depends a lot on your family circumstances, as well as your financial position, and how desperate you are for house or investment property.

But ultimately, what I think everyone should understand are 3 basic points:

1) Home prices are still 30% overvalued compared to long-term norms. These levels of overvaluation are still the highest of all-time.

2) Homebuyer demand has collapsed and is near the lowest level in 15 years. While demand might rebound at some point, it is unlikely to make a meaningful recovery until prices and mortgage rates decline by more.

3) Low inventory, driven by a refusal of sellers to list their homes, is the only thing keeping this housing market from an outright crash right now. While it makes logical sense that listings are low today, there's also many paths for listings to increase significantly in the future (from investors, Airbnb operators, the 12 million vacant homes, and the sky-high DTI mortgage borrowers), particularly if the economy worsens.

Meaning that it is a risky proposition to buy in today's market.

Some of you might be okay taking that risk. Others might not.

But I think whatever you do, you should be anchored by the right expectations. And that's for home prices to decline further into the future (the most probable outcome).

The only way I see a situation where prices won't go down into the future is if America enters an inflationary spiral where wages and rent surge, factors which would correct today's home price overvaluation without needing substantial price declines. That outcome is of course a possibility, but one that doesn't seem imminently likely given the deceleration in rent and wage growth in the economy.

8) What are you doing in today's Housing Market? Will you buy in 2023 or wait?

What is your outlook for the Housing Market going forward, and what are you thinking as an investor or homebuyer about the data I showed you in this post?

Let me know in the comment section below.

Additionally, please take 2 minutes to fill-out a brief survey I put together so I can better understand your journey as a homebuyer or investor. Your responses to this survey will help me improve the content of these blog posts, my YouTube videos, as well as the features on Reventure App.

Overall, my goal is to add as much value as possible to your home or investment property search. And your feedback is paramount in helping me do that.

Here's a link to the survey: https://www.surveymonkey.com/r/TCKNWZN

-Nick

Comments ()