Rents are now dropping in 57 out of 100 Large US Cities

Rents are now officially dropping in most US Cities, with new data from Apartment List showing that rents in June 2023 were lower than the previous year in 57 of the 100 largest cities in America. With the biggest rent drops occurring across the Southwest in cities like Las Vegas, Phoenix, Austin, and Riverside, as landlords there now suddenly struggle to fill vacant apartments.

These declining rents are welcome news for both renters and homebuyers in the US Real Estate Market, as they signal an ongoing "housing deflation" that could cause home prices to drop further in the second half of 2023.

Moreover, a record surge in apartment construction this year suggests we will continue to see new supply delivered over the next 1-2 years. These new apartment deliveries should apply further downward pressure on rents and eventually push some struggling landlords to sell.

Rental Market downturn is biggest in Pandemic "Boomtowns"

You've all heard the expression "what goes up, must come down". Well, that old adage is playing out as we speak in pandemic boomtowns, where a surge in inbound migration during the pandemic caused rents to go way up in 2021 and 2022.

But in 2023 the rents in these locations are now dropping, with the map below from Apartment List highlighting the markets with the biggest rent declines. Henderson, NV, a suburb outside of Las Vegas, experienced the biggest drop with rents falling -7% over the last 12 months.

And ultimately these declining rents are a function of increasing vacancies. The surge in rents during the pandemic was so severe in areas like Las Vegas that it priced out locals from being able to afford an apartment. The result was a big wave of household consolidation in late 2022 into 2023, where people moved in with friends and family to save money. This reduced rental demand and created more vacancies.

At the same time, the eviction moratoriums from the pandemic lapsed, triggering a deluge of evictions in metros like Las Vegas that opened up even more vacant apartments, causing the apartment vacancy rate to skyrocket from 2.5% in August 2021 up to 8.7% today.

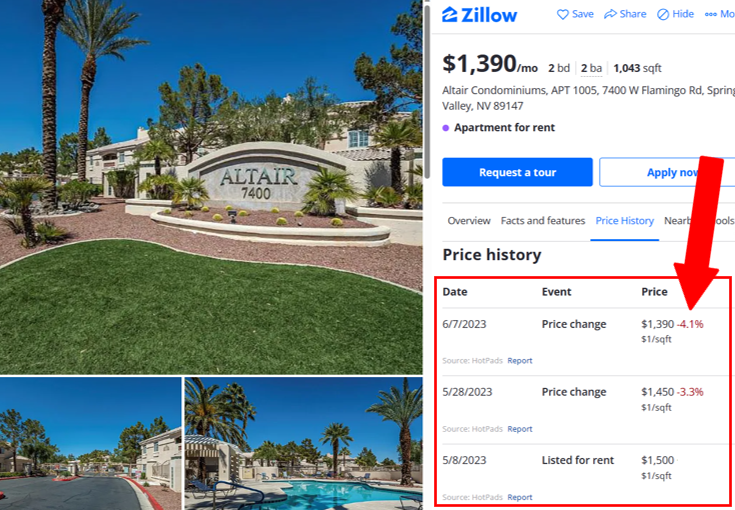

All this vacant apartment supply is now causing landlords to compete against each other to attract tenants by offering reduced rents and/or generous concessions (e.g., 1-month free rent).

Why Rents will Keep Dropping: 1 million units Under Construction

It's likely that vacancy rates will continue to increase over the second half of 2023 because apartment developers went a bit crazy during the pandemic and are now building over 1.1 million new apartment units.

That construction backlog is near the highest level on record and will be unleashed onto the rental market over the next 18 months as the units are completed, creating even more downward pressure on rents.

Meanwhile, there's also 840,000 single-family homes in the construction pipeline, which is also well above the historical average. Many of these single-family homes are being built purposely as rentals, which will further add to supply.

Lower Rents = Lower Home Prices?

The first order impact of lower rents is relief to renter households who are struggling to afford the cost of rent. However, the longer-term impact of lower rents will likely be to homebuyers in the form of declining home prices.

That's because growth in rents tends to feed into home prices over the long run, a trend observed by looking at the historical Home Price to Rent Ratio in America.

Right now, that ratio is at 15.4x, calculated by taking the typical home value of $340,000 from Zillow and dividing it by the average annual apartment rent of $22,000 per year (sourced by combining Zillow's rental rate data with the BLS' historical rent CPI growth).

Meanwhile, the historical long-term average Price / Rent Ratio is only 11.3x, indicating that home prices today are overvalued by about 27% compared to prevailing rent levels.

Home prices being overvalued compared to rent will inevitably lead to reduced demand to buy houses because it makes more financial sense for 1) first-time homebuyers to remain renting and 2) investors to sit on the sidelines and wait for yields to improve.

This reduced demand to buy houses should eventually lead to home prices coming down until they meet the fundamentals dictated by rental rates.

Alternatively - rents could go up to meet the level of home prices. Something like this happened during the big inflation of the late 1970s and 1980s, when rental rate growth averaged over 7% per year for a decade. As a result, home prices never declined because rents caught up.

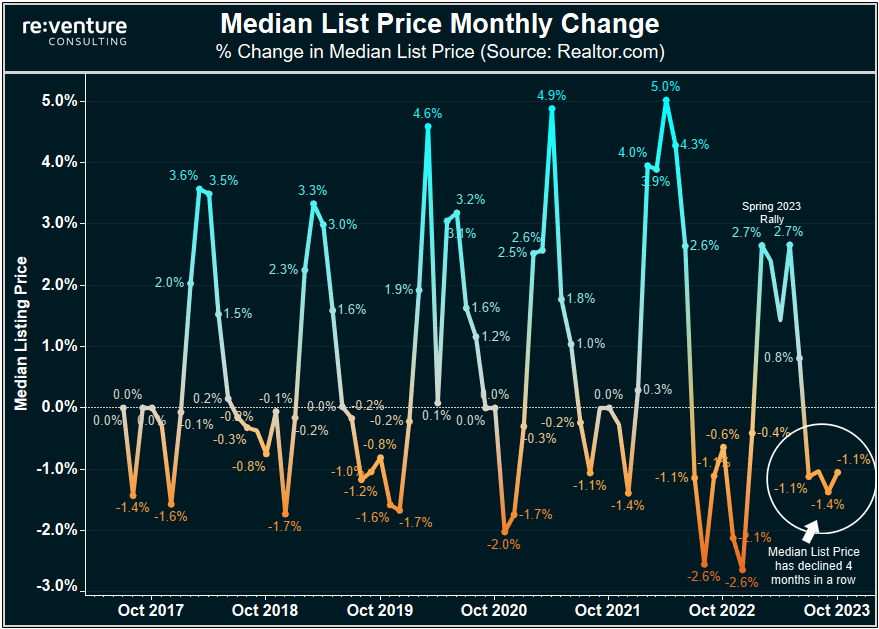

However, the home price bubble is much bigger in 2023 than it was in the 1970s. On top of that, rent growth is already sliding into negative territory in most cities, suggesting that increasing rents won't be there to "save the housing market" this time around.

Rental demand is declining in spite of 7% Mortgage Rates

One fascinating aspect of the rental market downturn in America in 2023 is that it's occurring while Mortgage Rates have surged to 7%. These sky-high mortgage rates have caused homebuyer demand to crash, which suggests that rental demand should be going up (because after all, everyone needs a place to live, right?).

But interestingly, rental demand is actually going down in the face of these sky-high mortgage rates.

I believe this is because households were scarred by how much the cost of housing went up in 2021 and 2022. In a metro like Miami, rents increased by nearly 50% over three years, surging from $1,800/month directly before the pandemic to over $2,800/month today.

In the same period, incomes barely budged, with the result being that Miami renters went from paying 38% of their gross income towards rent to now over 50% according to data from Reventure App.

That type of horrendous affordability ratio is now causing rental demand in Miami to drop, which is causing the vacancy rate to creep up, and rent growth to stagnate.

However, one thing that needs to be made clear about this rental market downturn is that it's still in its early stages. And that there is likely a long way to go before we can start to say that housing has become "affordable" for the average American household, especially in a city like Miami.

Top 10 Cities where Rent has gone down the Most

With all that said - what are the cities in America where rents have gone down the most over the last year? Well, according to a recent article from Realtor.com, they are universally concentrated in warm-weather climates that people moved to during the pandemic.

Austin, Las Vegas, Phoenix, and Riverside top Realtor.com's list with rent declines measuring -6.0% YoY, similar to the figures reported by Apartment List.

Other metros with sizable rent drops include Charlotte, Dallas, Sacramento, and Tampa coming in around -4.0%. San Francisco's rent also went down by -4.0% and is the only metro on the list where rent today is lower than it was three years ago when the pandemic started.

Will these Rent Declines result in Forced Selling from Landlords?

About one year ago on YouTube I predicted 1) that the rental market would crash and 2) that landlords would be forced to sell properties as a result. Thus far my first prediction has started to come to fruition, however the second one hasn't. The roughly 20 million landlords in America are still holding on to their properties and haven't started selling.

However, the longer that rent growth stagnates while interest rates remain elevated, the more pressure there will be on landlords to sell. Particularly ones who purchased over the last two years.

That's because we're now one year into a situation where Mortgage Rates, or the cost of debt for these landlords, has exceeded the Cap Rate (their rental profit). This means that many landlords who purchased over the last year are losing money on their rental property after paying interest on their loan (plus higher expenses like property taxes and insurance).

Landlords weren't too worried about this situation, dubbed "negative leverage", at first. That's because they expected rents to continue growing and for Cap Rates to increase as a result.

But that hasn't happened. Rather, rent growth has stagnated with the Cap Rate for the average US rental property remaining stuck at 4.6% (less than the return on a two-year US treasury).

This is not a situation that will last for much longer in my opinion. At some point something needs to give. Landlords are earning too little to take the risk on holding rental properties in increasingly distressed markets like Austin, Riverside, and Phoenix.

Right now, the easiest "give" is for landlords with rental properties in these markets to sell, thereby causing home prices to go down, and cap rates to go back up.

Keep an eye on the Rental Market in your City

Prospective homebuyers and real estate investors would be wise to keep an eye on the rental market in their city, because it could inform of you where the broader housing market is heading in future years.

If apartment vacancies continue building, and rents keep dropping, it could be a signal that housing deflation has hit in your area. A trend which has a high likelihood of dragging down home prices into the future.

Let me know in the comments below what you're seeing in your local rental market. Are the rents dropping?

-Nick

Comments ()