Mortgage Rates back to 7%. Another Homebuyer Collapse Coming?

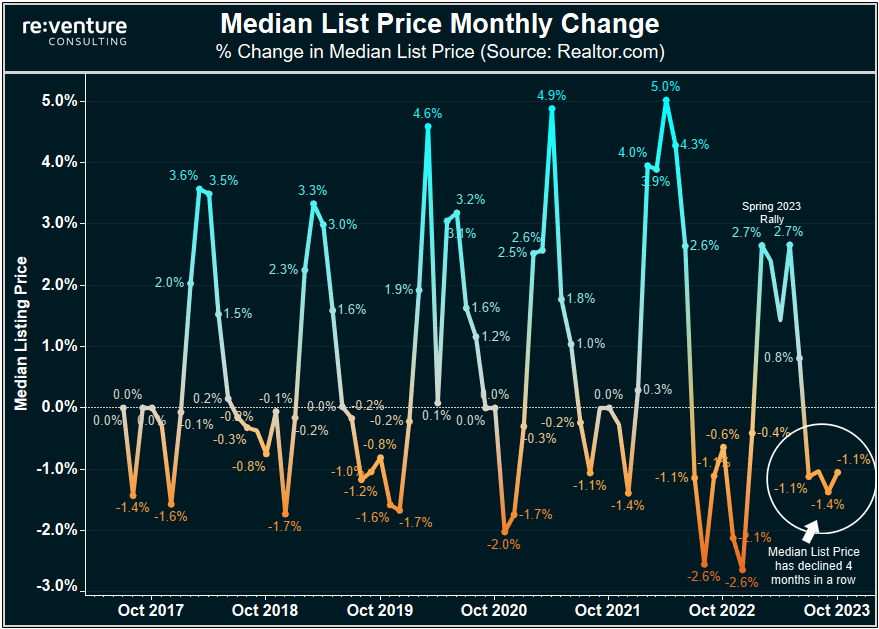

Mortgage Rates have roared back to 7% on the 30-year fixed. A signal that there will likely be another collapse in homebuyer demand in the US Housing Market. And that sellers should get ready to cut prices over the summer.

First things first - here's a chart from Mortgage News Daily showing up to date mortgage rates. You can see that today's 30-year fixed rate is trading at 6.95%. Which is up significantly from the lows of 6.1 to 6.2% that occurred in early April in the wake of the Silicon Valley Bank Crisis.

These re-surging mortgage rates are a big problem for the US Housing Market. Because they mean that prospective homebuyers will be even more squeezed on their ability to afford payments and qualify for mortgages. Likely resulting in a further drop in homebuyer demand over the summer - just when buyer demand should be peaking.

Homebuyer Decision in 2023: cost to Buy v Rent

There are a variety of ways to visualize the terrible lack of affordability in the US Housing Market right now. But one of my favorite ways is by making a very simple comparison: how much does it cost to buy a house vs. rent an apartment?

After all - this is the choice the vast majority of first-time homebuyers are facing. And right now the choice is clear: renting is a much more affordable option than buying. With the median rent in America currently clocking in at $1,850/month. About 30% cheaper than the median cost to buy of $2,700/month.

Note that this is by far the biggest nominal gap in buy cost vs. rent cost in US history. And in percentage terms it's only exceeded by the period in the early 1980s when mortgage rates hit 18%.

Meaning that homebuyers in the 2023 Housing Market are facing a historical lack of affordability that could cause another decline in homebuyer demand in the Summer.

Buyer demand is already very low. It could drop further in the Summer.

Before getting into my predictions for the Summer 2023 Housing Market, it is important that you understand something: that homebuyer demand is already exceedingly low.

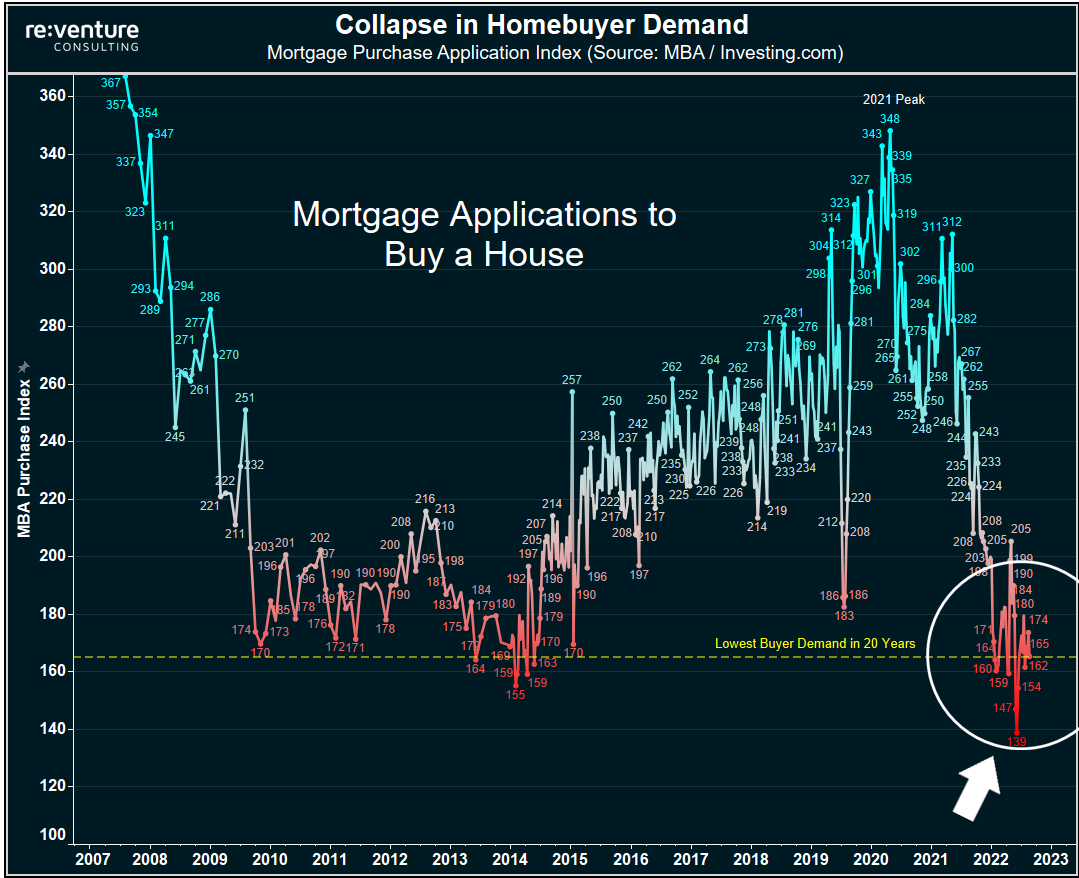

Seriously. Check out this graph. Mortgage applications to buy a house in May were down -26% YoY and by more than -50% compared to the pandemic peak in 2021. And were basically sitting at the lowest levels in 20 years according to data from the Mortgage Bankers Association.

Now that's before Mortgage Rates jumped back up to 7%. Indicating that there is likely more downside ahead for homebuyer demand if rates sustain their recent upward shift.

Expensive cities will get hit hardest by higher Mortgage Rates

I suspect these higher mortgage rates will do the most damage to homebuyer demand and home prices in already expensive markets.

And by expensive I mean the markets where the cost buy a house is significantly higher than the cost to rent. A place like Los Angeles-Orange County. Where the typical buyer needs to spend $5,400/month on mortgage interest, taxes, and insurance in 2023.

Compared to $2,900/month to rent an apartment.

Los Angeles' +86% differential in the Buy v Rent Calculator is one of the highest in America. And highlights how there's no room for buyers to absorb higher mortgage rates. Home prices will need to come down in LA to attract buyers back into the market.

Reventure App allows you to see a list of the markets with highest Buy v Rent Cost by selecting "Buy v Rent Calculator" under Premium Data Points and then "Table View". You can see that California cities dominate the un-affordability list, to go along with metros like Seattle, Salt Lake City, Austin, and Portland.

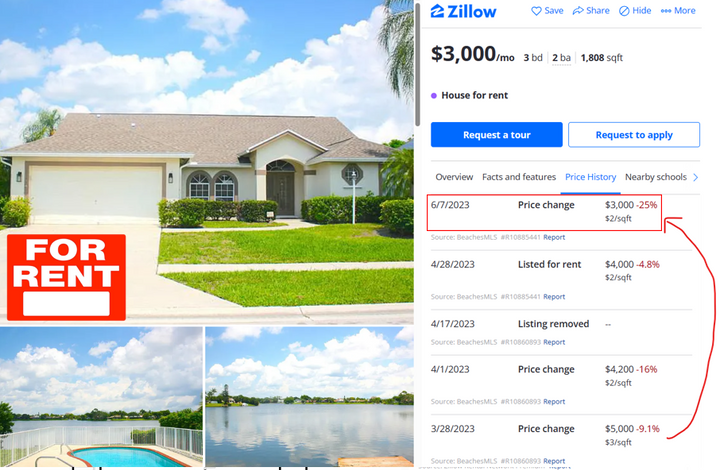

These are cities where home prices were already on the decline. I expect these declines to continue in the second half of 2023 as more inventory hits the market and sellers get desperate to cut the price before the fall and winter.

(Note: this data in Reventure App assumes a 6.4% mortgage rate. Meaning the Buy v Rent Calculator will look even worse for these cities next month when the data is updated for higher rates.)

Amazingly - it's still cheaper to buy in these 10 Cities

But not everywhere in the US is like California and Austin. Amazingly, there are actually a handful of cities where it is still cheaper to buy than it is to rent.

One such metro is Memphis, TN. Where the cost to buy of $1,469 is slightly below the cost to rent of $1,491. Indicating that the local population in Memphis still has an incentive to purchase a home in 2023, even at near-record high prices and 7% mortgage rates.

As a result, could Memphis and the other cities shaded in BLUE on the map below, perform better in this higher mortgage rate environment?

Possibly.

One thing we're learning in the early stages of the 2023 housing downturn is that many households still want to take plunge into the homeownership. Even if they suspect that they're overpaying. And whether these households do end up buying is based on comparing the buy v rent costs in the market. As well as their ability to qualify for a mortgage.

Overall, the markets with the best affordability today are located in the Midwest and Deep South. These are areas of the country that experienced lower appreciation rates over the last decade. And thus leave buyers with more room to afford houses today.

We're talking about markets like Jackson, MS. New Orleans, LA. Toledo, OH. Baton Rouge, LA. Winston-Salem, NC. Pittsburgh, PA. Augusta, GA.

Not exactly the "sexiest" list of markets. But the data is the data. These markets all register a negative on the Buy v Rent Calculator, meaning it's cheaper to buy than rent in 2023.

I suspect they will perform better in terms of holding value over the next 1-2 years as the housing downturn worsens.

Will Mortgage Rates stay at 7%?

This surge back up to 7% mortgage rates caught me by surprise. Because based on the headlines in the economy, mortgage rates should be declining.

After all, America is in the midst of a credit crunch, banking crisis, and early stages of a recession. Jerome Powell came out recently and said interest rates wouldn't have to increase "as much as expected" to tame inflation. All signs pointing to lower interest and mortgage rates into the future.

But rates are going higher, not lower.

WHY?

One possible reason is due to America's debt-ceiling standoff. Perhaps institutional bond buyers want higher yields to compensate for the risk of a US default? I thought that sounded plausible. Until I looked at realized that UK Interest Rates experienced a similar surge in the last couple weeks. Same with Canada.

That suggests something global is going on.

Perhaps global bond buyers are expecting inflation to get worse in coming months. And demanding higher yields on government bonds as a result to compensate for higher inflation into the future.

That's a definite possibility. And seems to be the best explanation for what's going on right now. However, higher inflation is not supported by the data we're seeing on bank lending, commodity prices, and wage growth. These indicators are decelerating or declining, signals that inflation will continue to slow.

So this is all a bit confusing. Lots of mixed signals are being sent throughout the economy.

Me personally - I don't think mortgage rates will sustain themselves at 7% for long since the economy and financial system doesn't seem equipped to handle it (the last time rates went to these levels in early March, Silicon Valley Bank happened).

Moreover, activity in the housing market was already at its lowest level in 20 years. How much lower can it conceivable go before it drags the entire economy down with it? (we're already see the ramifications of the housing downturn in earnings reports from companies like Home Depot).

I'm betting on lower rates into the future. But we'll have to see. Inflation has continually surprised to the upside over the last two years. Maybe it has another trick up its sleeve that keeps rates higher for longer.

I'm curious - where do you think Mortgage Rates will go into the future? Should the Fed keep hiking?

What are your thoughts on the direction of mortgage rates and Fed policy into the future? The Fed has signalled that they may stop hiking in June. Do you think that's a mistake and that they should keep hiking?

Let me know in the comment section below.

Also make sure to check out the Buy v Rent Calculator data on Reventure App to see how your market might be affected by higher mortgage rates.

(Go to "Select Data Point" --> "Premium" --> "See More" --> "Buy v Rent Calculator")

-Nick

Comments ()