Is the Housing Crash Over? Here's the truth

If you haven't noticed - the narrative on the Housing Market has shifted significantly over the last month.

Mainstream financial outlets like the Wall Street Journal are reporting on an improving Housing Market. The CEO of Redin is boasting about how "strong" the Housing Market has been to start 2023. All while anecdotal stories of bidding wars are permeating social media and creating a sense of fear among buyers that the Housing Crash is over. And that prices could start going back up.

So...what's the truth? I'm going to lay it out for you in this post.

1) Homebuyer demand has improved to start 2023. But it is still depressingly low.

Mortgage Applications to buy a house in February are up 12% from their lows in October 2022. And this increase is ultimately what is generating the more bullish sentiment on the Housing Market as of late.

However, there's a problem. And it's that buyer demand is still down 33% YoY. And remains at the lowest level in a decade.

What's more - buyer demand is over 40% lower than it was in the beginning of 2021 when the Housing Bubble really got going.

So the buyers are still very much "gone" from the US Housing Market. And it will likely remain that way until affordability improves substantially.

2) Americans still hate the 2023 Housing Market. Regardless of what Wall Street or Realtors say.

Many people on Wall Street, as well as many realtors, are speculating that buyer demand will continue to increase in 2023 based on "lower mortgage rates" and a "good January jobs report".

The trouble is that Americans - the people who comprise the homebuyers who support the US Housing Market - disagree.

Fannie Mae just released their monthly Housing Survey for January 2023 and it shows that a record 82% of Americans think it's a bad time to buy a house. Only 17% think it's a good time to buy. This is literally the worst housing market sentiment in history.

Quite the disconnect from the bullish narratives being perpetuated by real estate stakeholders. Until homebuyer sentiment improves, buyer demand is unlikely to return.

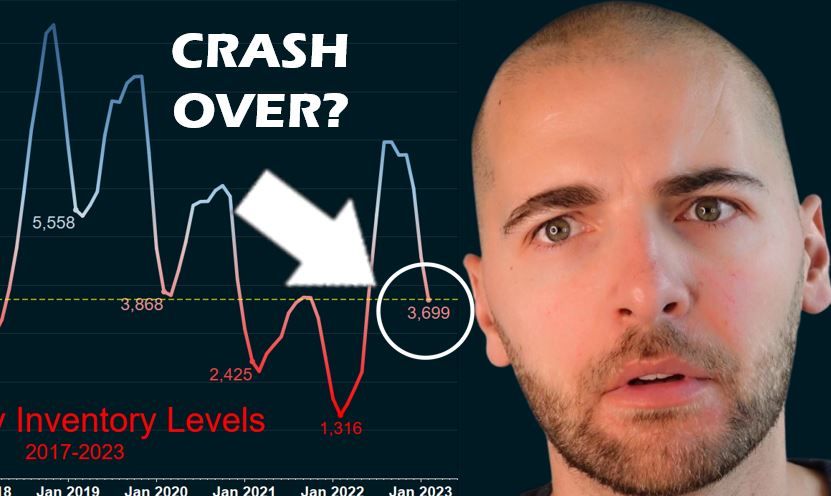

3) Seasonal Lows in Inventory are creating some bidding war situations.

It's important to remember that the Housing Market is a seasonal beast. Whether we're in a boom or a crash, listings will increase in the summer and go down in the winter. And right now we're in the midst of a seasonal low in inventory during the winter.

Take a look at a market like Seattle, WA to see an example. Active Listings in January 2023 were at 3,699 according to Realtor.com. Which is actually down by quite a bit over the last several months.

These seasonal lows in inventory are resulting in some bidding war situations for local buyers who feel compelled to buy in the winter. But there's nothing alarming about this.

We can see that inventory in Seattle crashes down every January. And today's 3,699 is actually 181% higher than what it was last year. And is also higher than the inventory levels in 2021, 2018, and 2017.

Starting in a month or two, inventory in Seattle will begin shooting up. And homebuyers will have way more options (and fewer bidding wars to contend with).

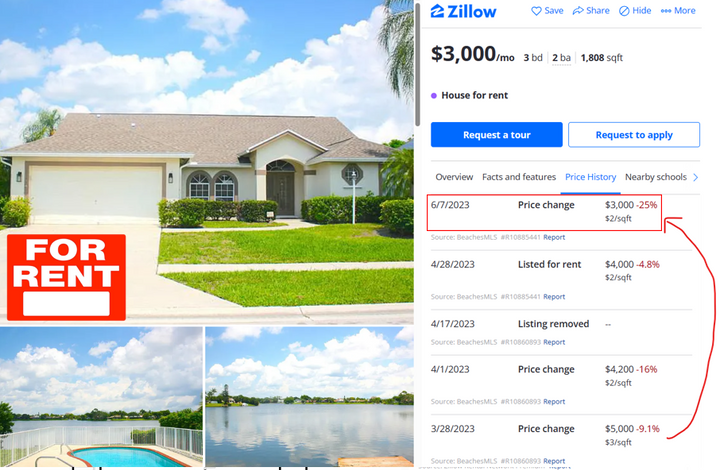

4) No. Homebuyers have not returned to Florida.

Another narrative I'm seeing spun on social media is that Florida is experiencing another rush of homebuyers from up north. With the implication being that Florida's Housing Market "won't crash" as a result of continued migration.

Trouble is - the data says the exact opposite. According to Redfin, 7 of the top 25 Markets with the biggest crash in buyer demand are in Florida.

The declines are epic. Pending Sales fell by -64% YoY in Naples. -55% in Crestview. -50% in Jacksonville. -47% in Pensacola. -47% in Palm Bay. -46% in Cape Coral. -44% in Miami.

Once again - what might be confusing some people is that we are currently in a seasonal period where there's lots of people traveling to Florida. It's a nice place to be in January and February when it's cold everywhere else. But the reality is that there are 40-50% fewer buyers in Florida today compared to one year ago. A signal that inventory will continue to pile up and that prices will go down as 2023 progresses.

5) But buyers are returning to the Midwest.

There are some cities where we are seeing buyer demand hold up. And they're almost universally in the Midwest.

According to Redfin, metros like Cincinnati, Chicago, Detroit, and Evansville, IN are flat on pending sales YoY. Meaning there are the same amount of buyers in January 2023, at 6% Mortgage Rates, as there were in January 2022 at 3% Mortgage Rates. Pretty crazy.

Demand also seems to be holding up in and around New York State. Rochester, Syracuse, and Newark, NJ still have a decent numbers of buyers.

The continued outperformance of the Midwest/Northeast Rust Belt is interesting. These are the places where everyone is supposedly moving out of and should theoretically be doing the worst. Yet they are doing the best.

Perhaps the migration trends during the pandemic are reversing.

6) It will take 20% Price Declines to bring buyers back.

The CEO of Meritage Homes, the 7th largest home builder in America, said some interesting things on their recent earnings call.

...our ASP (Average Selling Price) was close to 480 middle of last year, and we're now close to 390...We have to get to a payment that makes sense for our customers. And we believe that payment exists when we're under 400 ASP.

To translate: sale prices for Meritage have crashed by 20% over the last 6 months, from a peak of $480k now down to $390k. Meritage is making these adjustments because they feel like they need lower prices in order to make homes affordable enough for to bring buyers back.

And the plan seems to be working. Sales are now back up YoY:

We sold over 1,200 houses in January (2023), up approximately 4% over last January (2022). We have some initial confidence that we found the right combination of pricing incentives to sell at our targeted three to four net sales per month.

Ultimately this is a lesson for sellers in the Housing Market more broadly. Marginal reductions in Mortgage Rates aren't going to bring buyers back. But big price reductions will.

7) Oh yeah. About that Jobs Report.

Seemingly every large publicly traded company is conducting large layoffs. Yet the BLS just reported that America added over 500k jobs in January and that the unemployment rate is still a near record low 3.4%.

What gives? How are the government labor figures still so strong with all these layoff announcements?

The answer has to do with the fact that America is still "adding back" much of the job growth that was lost during the pandemic. For instance, today's 155 Million payroll count is still 3 Million below what employment would have been if the pandemic never happened (and the 2016-19 trend continued).

Particularly in service industries like restaurants, hotels, and events. Where job counts are still substantially below pre-pandemic levels and employers are still in "re-opening" mode.

Meanwhile, the layoffs announced so far have concentrated mostly in white collar industries and number less than 300k. And thus are getting swamped in the employment report by the jobs being added in lower-wage industries.

Ultimately the realities of a declining housing market, inverted yield curve, and worrisome leading economic indicators will result in problems for the labor market. But it's taking longer than many, including myself, expected.

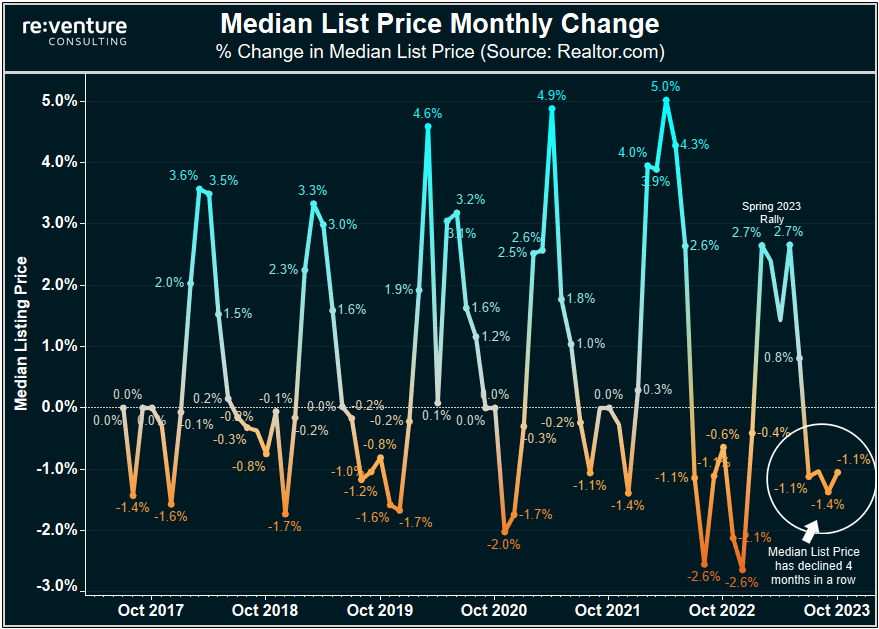

8) No compelling evidence that Housing Crash is over.

I don't see any compelling evidence that the Housing Crash has bottomed. Buyer demand is still very low. Buyer sentiment is horrible. So are affordability metrics. It's still cheaper to rent than buy. These headwinds will keep homebuyer demand subdued throughout 2023.

On the supply side Inventory on, a national scale, is still low compared to pre-pandemic norms. But in markets like Dallas, Tampa, Nashville, Salt Lake, and San Francisco inventory is now back to or above the long-run average.

It's really the Midwest/Northeast that's skewing the inventory figures down and creating the perception of an undersupplied Housing Market.

As the spring selling season comes, expect more inventory to hit the market from sellers who didn't want to list in 2022. Just as buyer demand remains low. Creating a very big inventory pileup in certain cities. And bringing the national figures more in-line with 2018/2019.

I hope that helps clarify what's happening in the Housing Market and Economy right now. Stay tuned for some very exciting announcements in future weeks about Reventure App (hint: it's almost done).

In the meantime - please let me know in the comments what you guys are seeing your local housing market. Is it still dead? Have buyers returned? How are prices looking?

Be sure to indicate what your metro area is.

-Nick

Comments ()