Inflation is BACK. Mortgage Rates to 10%?

After a brief hiatus, Inflation is now roaring back into the world economy in early 2023. The result is spiking interest rates and mortgage rates.

Many homebuyers and investors are now asking:

- Just how high can these Mortgage Rates go?

- Could we be in for a repeat of the 1970s/80s when Mortgage Rates eclipsed 10%?

- And if that does happen...what will be the impact on the US Economy and Housing Market?

These are big questions. And I will provide the answers in this post. Let's get started.

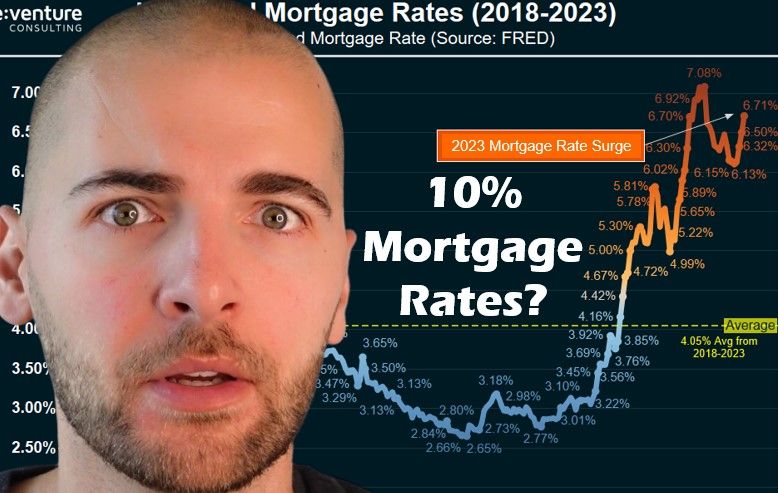

1) Mortgage Rates are surging again.

The 30-Year Fixed Mortgage Rate jumped to 6.71% during the last week of February according to Freddie Mac. That represents a fairly sizable increase over the levels one month ago and is now approaching the previous highs near 7% that were set in November 2022.

This increase in Mortgage Rates has been a major shock to homebuyers considering rates averaged 4% the last five years. And this shock has turned into a buyers strike. With mortgage applications to buy a house recently crashing to the lowest level in nearly 30 years.

But these rates could go even higher in coming weeks/months. That's because...

2) Inflation is back.

The inflation barometers are spiking again.

It started a couple weeks back when the BLS reported a hefty +0.52% CPI increase in January. That increase crushed hopes that the moderation in inflation in late 2022 was the sign of a new trend.

And there's been other concerning inflation readings since. The ISM Manufacturing Report for February 2023 showed a sizeable increase in raw materials prices paid by manufacturers.

On top of this - inflation reports out of Europe confirm a re-acceleration of inflation to start 2023. Particularly Germany, who just announced a very hot inflation report. Since inflation is usually a global phenomena, higher inflation in Germany increases the chance that the next US CPI Report will come in hot as well.

All of this is to say: after a couple-month hiatus, inflation is back. Causing many to speculate that we could be seeing a repeat of the Great 1970s Inflation occur right before our eyes...

3) The 1970s Inflation was very bad. And the 2020s inflation looks similar so far.

For those that weren't alive or don't remember: the 1970s Inflation was very bad.

It was basically a full decade of what we've experienced the last couple years. For the entire 1970s inflation never went below 5%. And it had two major peaks where inflation went as as high 15%.

What's concerning is that the first several years of the 2020s inflation (orange line) looks very similar to first several years of the 1970s inflation (blue line).

While the initial peak of this inflation isn't as bad (8.9% v 12.2%), the inflation has a very similar shape. With that initial run up occurring two years in, and then a disinflationary period taking hold. Creating the unnerving prospect that we're only several years into a long, drawn-out period of inflation.

What's even more concerning is that if we have a repeat of the 1970s, then Mortgage Rates will likely be going much higher. Consider that Mortgage Rates were above 10% for most of the 1970s.

And they eventually peaked all the way up at an astronomical, wow-inducing 18% in 1981. And the reason they did this was because of consistent, decade-long inflation which pushed long-term bond yields into the stratosphere.

But this begs an interesting question...are we really in for another 1970s style inflation, and 10%+ Mortgage Rates, over the next several years?

I don't think so. Because put simply: the American consumer and homebuyer cannot afford it.

4) Americans don't have money in 2023. Which is why the inflation will fizzle.

What people often forget is that there are two sides to the inflation coin. The first side is the one everyone is familiar with: consumer price increases. Seeing groceries, gas, and rent get more expensive.

But for the inflation to sustain itself, something else needs to happen: wages need to go up. If wages go up enough, and we hit a wage-price spiral, then inflation can continue for a decade like in the 1970s.

But if wages don't go up enough, people will eventually run out of money and won't be able to buy goods and services at higher prices. Inflation gives way to deflation in this scenario, like in the Depressions that occurred from 1920-21 and 1929-33.

And the data is currently telling me that a deflationary Depression in the 2020s is a greater likelihood than a Decade of Inflation. All you have to do is look at the Personal Savings Rate to see why...

5) Record Low Personal Savings

Right now the Personal Savings Rate is at a historically low 4.7% (meaning that the average American is only saving 4.7% of their income each month).

Such low a savings rate indicates that wage growth in America has not kept pace with the increase in consumer prices over the last two years. Which is a very different situation from what occurred in the 1970s.

Back then, the Personal Savings Rate was consistently above 10%. In fact, during the first inflation peak that occurred in 1974, the savings rate almost hit 15%!

Meaning: even though consumer prices (and home prices) were going up by double-digits in 1970s, incomes kept pace with those increases. Higher incomes allowed Americans to absorb the price increases, and then still have nearly 1/6th of their incomes left over! That excess savings could then be plowed into buying more goods at higher prices next month. And that's how you get the wage-price spiral and decade of inflation that occurred in the 1970s.

But the current situation in 2023 is nothing like that. Consumer spending today is not being fueled by excess wage growth, but rather through 1) a glut of savings that occurred in 2020-21 during the pandemic, and 2) credit cards and consumer loans.

Those means of fueling spending will likely run out at some point. Especially as the Fed contracts the money supply through quantitative tightening. And as banks and credit companies tighten their lending standards.

What will happen to the Economy when the Savings and Credit inevitably runs dry? Well...

6) Recession / Skyrocketing Unemployment occurs in 2023-24 (aka, the Fed "breaks something")

Here's what's going on in the economy right now:

- the Fed is aggressively hiking interest rates and contracting the money supply,

- during a period where numerous early warning indicators are flashing RECESSION in big letters,

- just as American consumers are stretched thin and struggling to save money

You don't need to be a PhD Economist to understand how this combination of factors will create a situation where the Fed "breaks something". And a recession occurs (potentially a bad, deflationary recession where the unemployment rate skyrockets and consumer prices drop precipitously due a lack of demand).

What scares me is that the prospect of this type of recession is being increasingly "written off" by those in mainstream finance. For instance, Goldman Sachs just cut their recession odds to only 25% in 2023. Jamie Dimon, who once said an "economic hurricane" was coming for the US Economy, now only predicts a mild recession.

There's this idea building that since the recession hasn't happened yet, it won't happen. And that even if it does happen, there will be a "soft landing" with minimal consequences for the economy.

The problem with this line of thinking is that it has no historical precedent. The Fed has never achieved a soft landing. And over the last 70 years in the US Economy, every time we've seen the current combination of Inflation + Fed Rate Hikes + Inverted Yield Curve + Housing Downturn, we've had a bad recession.

So based on the historical data, the recession is not a matter of IF, but WHEN...

7) Leading Indicators say Recession by Fall 2023.

And WHEN can be tricky to predict. Many, including myself, originally expected that by early 2023 the US Economy would already be in a firm, unquestionable recession with a spiking unemployment rate. But that hasn't happened.

One reason it hasn't happened yet is that the economic cycle in America operates on a significant lag. Especially in relation to changes in interest rates. When interest rates get hiked, it usually takes 12-24 months for their negative impact to be felt on the economy.

You can see evidence of this this lag, and potentially predict WHEN a recession will occur in 2023, by looking at America's history of Yield Curve Inversions

(a Yield Curve Inversion occurs when short-term interest rates exceed long-term rates).

Historical Yield Curve Inversions have been very reliable predictors of recessions in the past. So much so that the 1-year v 10-year treasury curve has inverted prior to every recession in America over the last five decades.

Typically, it takes 15 months from the date of initial inversion to when a recession is officially declared.

This cycle's Yield Curve Inversion started July 2022, implying that if the historical trends hold, America will be in an official recession around October 2023. Another seven months from now.

And make no mistake: Yield Curve isn't the only leading indicator implying similar recession timing. Historical data tracking the home sales cycle also implies a mid-to-late 2023 Recession start. As does the the Conference Board's Leading Economic Indicators Index.

8) 2023 Recession = Forced Selling, Foreclosures, and lower Mortgage Rates.

All of this is to say: a Recession where the unemployment rate spikes is still likely in 2023. Maybe even a near certainty given the historical trends.

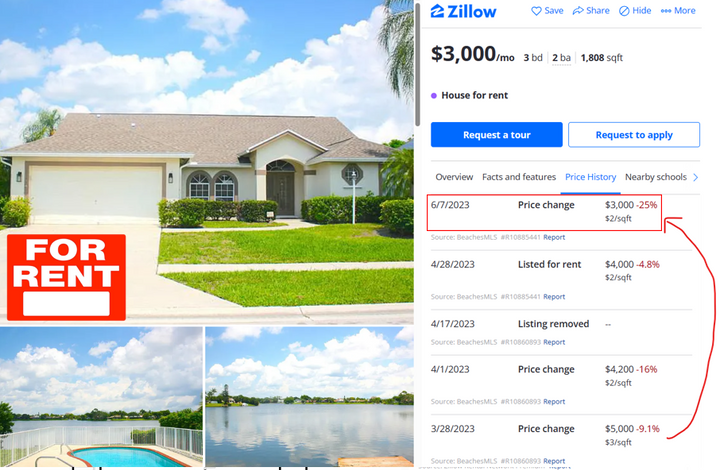

Such a recession will have numerous impacts on the US Housing Market. For starters, a wave of forced selling of 2nd homes and investor homes is likely as the layoffs mount. Mortgage defaults will also spike as people lose their jobs, bringing about a wave of foreclosures.

But a recession will also result in lower mortgage rates. That's because long-term bond yields tend to decline in a recession as the Federal Reserve cuts interest rates.

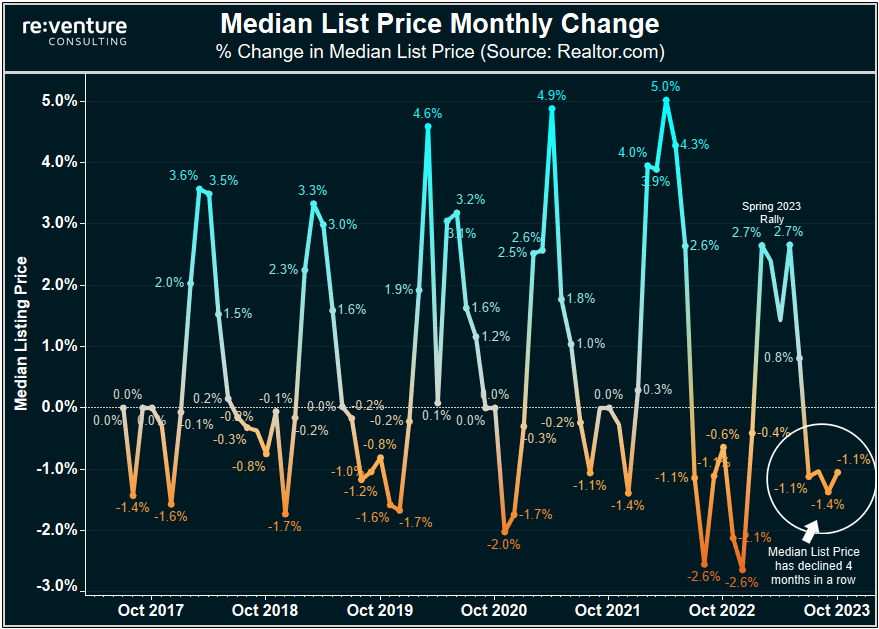

Ultimately, I could see the 30-Year Mortgage Rate descending below 5% sometime in 2024. Which sounds absolutely crazy to predict right now given the headlines about inflation and Fed rate hikes. But ultimately that's what today's fundamental data suggests is going to happen.

To be clear - don't take my prediction on mortgage rates as definitive or guaranteed. There's still a lot of volatility and uncertainty in the market. Heck - just one month ago everyone was convinced Mortgage Rates would continue going down. And now they're back up.

There's also some extenuating circumstances which could cause my predictions on inflation and interest rates to change. For instance, if the US Government were to do another big round of free money / stimulus checks, that would obviously be something that sustains inflation and higher interest rates.

Moreover, if America were to get into an expensive war financed by debt that would be another outcome that could cause high inflation and interest rates to persist.

But short of those interventions occurring, my prediction is for Americans to run out of money at some point in 2023, and for a deflationary recession to begin.

Now I'm curious: what do you think? Specifically:

1) do you think mortgage rates and inflation will continue to go up in 2023? Or will they go down?

2) when do you think the recession will officially start? Are you seeing signs of the recession in your own life?

Let me know in the comments below!

-Nick

Comments ()