How the Immigration Crisis will impact Home Prices

A record 2.4 million immigrants crossed the Southwest Border in 2022.

More will cross in 2023.

These historic levels of immigration will have a big impact on both the US Housing Market & Economy over the next several years. Trends that you should be paying attention to as a homebuyer.

In particular, I believe that the record surge in immigration will worsen the deflationary recession that America is hurtling towards in 2023 by lowering wage growth. Which will have the corresponding impact of causing both home prices and rents to go down in the short-term (1-3 years).

However, over the long-run(5+ years), this high immigration will increase home prices and rents in specific destination cities like Miami.

The first half of the post will explore immigration's impact on the macro economy and the trajectory for a recession in 2023. The second half will dive into the housing market specifics.

But first, a disclaimer before getting started: the immigration topic is emotionally charged. It's politically divisive. My goal in this post is to cut through the emotion and political BS to objectively isolate the economic and housing market impacts you can expect from it as a homebuyer, investor, and worker in the US economy.

1) 2.4 Million Immigrants crossed the border in 2022.

Step 1 is to understand just how many immigrants are crossing the border. And how today's levels compare to historical norms.

According to US Customs & Border Patrol, there were 2.4 million "encounters" with migrants at the Southwest Border in fiscal year 2022 (an encounter is defined as an apprehension of an illegal migrant under U.S. Code Title 8 or 42).

2.4 million is by far an all-time high. It smashed the previous record of 1.7 million set in 2021. And it's roughly 3x the normal, long-run average going back to 1970.

Updated data from US Customs and Border Patrol shows that the US is on pace for another 2.4 million in fiscal year 2023. A figure which could grow higher if the repeal of Title 42 causes more people to cross the border.

So, objectively speaking, we can say that there is a historic wave of immigration occurring. Quite literally unlike anything the US has seen in the last 50 years.

Now, what will the impact be on the Economy?

2) Labor Force will expand significantly. Labor shortages will ease.

The first-order impact of the big surge in immigration will be an expansion of the labor force in America, specifically in lower-wage industries.

Data from the White House shows that 73% of the undocumented immigrant adults in America are employed. Applying that ratio to combined immigration estimates for 2021-2023 (6.5 million) implies that the US Labor Force will have grown by 4.7 million due to illegal immigration by the end of 2023.

That's a substantial 2.8% growth rate in the labor force that is not going to show up in the official statistics from the US Government. Since the majority of undocumented migrants are paid "under the table".

The under the table migrant workers provide an economic benefit by helping resolve the intense labor shortages that have occurred in the US economy over the last year, especially in industries like food services and construction. Job opening in these industries have declined significantly over the last year, likely because htey were filled by migrant workers.

3) Immigration + Fed Tightening = LOWER WAGES?

While resolving labor shortages is the positive economic impact associated with record illegal immigration, there will also be a negative impact: a depressive effect on wages for Americans.

The White House cites research showing that undocumented workers accept 5% to 25% less pay for the same job compared to native Americans. As a result, undocumented workers reduce wage growth for Americans in low-skilled, service sector jobs.

A trend that could already be playing out. Weekly wage growth for US workers peaked at 6.8% YoY in March 2021. Right before the rush of illegal immigration started. Now it is down to 3.9% in the spring of 2023.

The good news is that 3.9% is still above the long-term average. However, I suspect wage growth will keep declining into the future due to the actions of the US Federal Reserve, which is intentionally trying to harm the labor market. Particularly through its sharp contraction of the money supply (the first such contraction since the Great Depression).

A contracting money supply means 1) less money for banks to loan out to businesses and 2) less money for businesses to pay workers.

Which means lower wage growth for workers. Occurring right when the supply of labor is surging due to immigration.

What happens next...?

4) The Depression of 1920 provides interesting lessons for today.

Well, let's look into history.

Believe it or not, this has all happened before. Over 100 years ago. Leading up to the Depression of 1920. When the unemployment rate hit 11% and we had 15% deflation in a year.

The similarities between 2023 and the lead up to the Depression of 1920 are eery to say the least. Let's run them down one by one.

1) Rapid expansion of money supply? Check. US Money Supply doubled during World War I. Meanwhile, US Money supply increased 40% during the pandemic.

2) Raging inflation that showed no signs of relenting? Check. Inflation was over 10% per year from 1917 to 1919. People thought it would never end. Sound familiar?

3) Global Pandemic that snarled supply chains and caused chaos? Check. The Spanish Flu of 1918 was the last global pandemic to get really bad.

4) Overly aggressive Fed that tightened monetary policy too much? Check. The Federal Reserve increased the discount rate in 1920 to 7%.

5) Resulting Money Supply Contraction? Check. Money supply went negative in 1921. One of only 5 times in history. One of those times is today in 2023.

and lastly, pay attention to this one:

6) Sudden surge in the supply of Labor? Check 1.6 million soldiers came back from WWI into the labor force, increasing labor supply by 4%. The labor force increase from the migrant workers in 2021-23 is closer to 3%, but could continue to grow.

The cocktail of those events back then caused a lightning-fast depression. Where the unemployment rate skyrocketed and the US economy was consumed by the biggest annual dose of deflation it has ever experienced.

Will a similar result hit the US Economy in 2023 and 2024? It certainly could. The trends and dynamics are all there for a deflationary recessionary, skyrocketing unemployment rate, and stagnating/declining wage growth.

5) Lower Home Prices & Rents in the Short-Term?

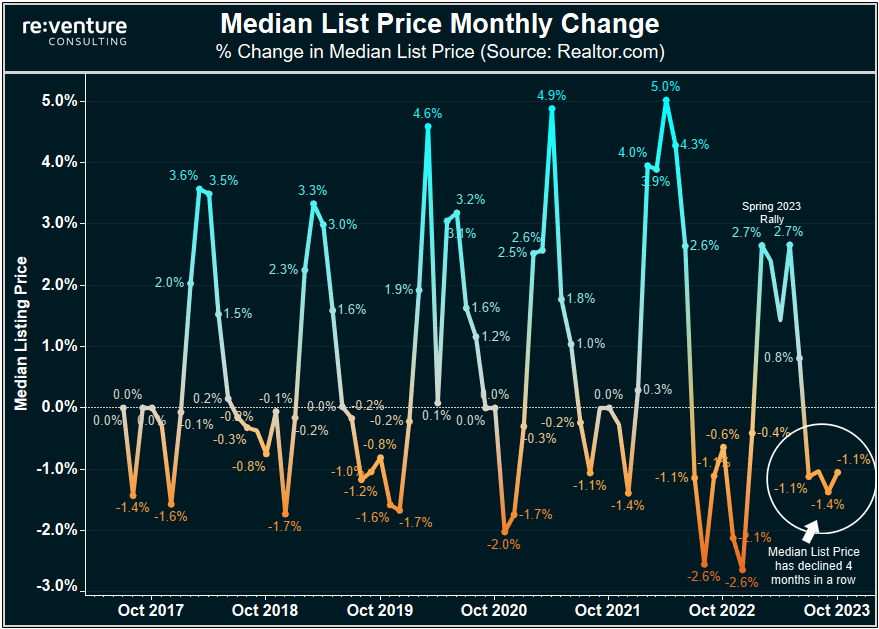

If history repeats itself, and America does have a deflationary recession in 2023 and 2024, then both home prices and rents will decline.

And again - this all goes back to wages. Home Prices relative to incomes in America are at all-time highs right now. With inflation-adjusted home price growth registering +92% since 1970. Compared to only +24% for median income growth.

That's clearly not sustainable. Home prices in America have never been able to stay this far above wages for long. Which means the only hope for the US Housing Market in sustaining these prices is a big increase in wages. Like what happened in the 1970s inflation.

However, a sustained surge in wages is looking less and less likely. Leaving only one direction to go for home prices: down.

It's a similar story for rents. In cities like Miami, the typical household is now paying over 50% of their income to rental costs according to data from Reventure App.

That type of rent-burden is not sustainable. Either 1) rents need to go down, or 2) wages need to go up. Or perhaps some combination thereof.

However, I'm skeptical that wages will grow in Miami. I spent a month there earlier this year and noticed how the local McDonalds near Wynwood was only paying $12/hour. When McDonalds' everywhere else in America are paying $14-15.

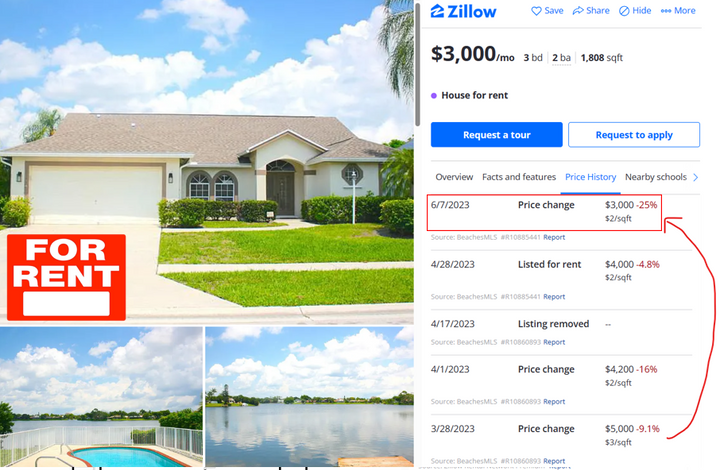

Clearly the wages in Miami are not growing enough. Meaning that a downturn in the local rental market in the short-term is increasingly likely.

6) But wait...more Immigrants = more demand for Housing. Shouldn't that increase home prices and rents?

But here's the twist. Increased immigration, in its most basic sense, increases the population in America. Which thereby increases the demand for housing. Which should theoretically increase rents and home prices given a relatively inelastic supply of housing.

Academic studies confirm this: more immigration tends to increase home prices and rents in the long-run.

In particular, a 1% increase in a city's population is associated with a 1% increase in rents and housing values over the long-run. Suggesting that homeowners and real estate investors will benefit from this increased immigration while renters will suffer.

The trouble is...we're not seeing an increase in demand for housing right now in America. In fact, it's the exact opposite. Rental demand is declining and vacancy rates are going up.

With data from Apartment List showing that the rental vacancy rate in America has surged from 4.1% in late 2021 to 6.8% today. Which is now slightly above pre-pandemic levels.

So that's strange. Over 4 million migrants have entered America in the last two years, but during that period rental demand decreased. With rent growth heavily decelerating year-over-year. Weird.

Weird until you start thinking about the journey that an illegal immigrant takes after they cross the border. Many end up in shelters. Others on the street. Most go to stay with friends and family that they know in America. Very fewer migrants are coming over the border and immediately renting their own apartment (even fewer are buying houses). After all - they don't even have an ID. And very likely don't have the money to afford the rent.

So what's driving the disconnect between the academic research and realities in the rental market right now? When will the increase immigration in America show up in the form of higher rents and home prices? And what cities will these increases show up in?

7) There's a lag.

I suspect that there's a sizable lag between a migrant's entry into America and their stimulative effect on the Housing Market.

It will likely take multiple years of working and saving for migrants to afford an apartment in America given the sky-high rents. And even then, they'll probably have to split the apartment with a roommate who has an ID and credit history.

So the effect on rental rates is muted at first. But gains steam over time. The academic study I mentioned earlier estimated the impacts of immigration on rent over 10 to 15 years.

Eventually the increased population from immigrants will translate into higher renter demand. Then higher rents. Then higher home prices. But this system operates on a lag and will take years to play out.

8) Higher Rents / Home Prices will be most pronounced in Immigration Destination Cities. Like Miami.

In addition to the lag, a homebuyer or real estate investor must also consider the locations of where immigrants tend to settle. And those locations are not evenly distributed.

Instead, they're clustered in specific immigration destination cities such as Miami, FL.

With 14.4% of the population growth in Miami-Dade County over the last 10 years coming from (legal) immigration. That's by far the highest growth reliance on immigrants of any county in America.

Other areas in America with a big concentration of immigrants include Boston, Orlando, the Bay Area, New York, Seattle, and Houston. These will likely be the areas that receive the highest share of illegal immigrants and should see the biggest boosts to housing demand, rental rates, and home prices in the long-run (5 to 10 years).

Looking at a map of the over 3,000 counties in America highlights just how concentrated immigration is in specific parts of the country. Particularly across southern Florida, southern Texas, Massachusetts, and the Bay Area (counties in orange).

Meanwhile, there are huge swaths across the Midwest, Southeast, and Mountain areas of the country that receive virtually no immigration (light blue). Meaning that these housing markets would be less inclined to experience higher rent and home price growth in the long-term due to immigration.

Note: this data from the US Census Bureau only tracks legal migration. It does not track the type of illegal immigration occurring over the Texas Border right now. As a result, there might be some differences in where legal v illegal immigrants settle.

However, the New York Times produced a snapshot in 2019 of where a sample of 1,500 illegal migrants went after crossing the border near El Paso. And the resulting map looks broadly similar to the one above.

9) Crash First, then Growth

What I'm anticipating is that both home prices and rents will need to crash in a city like Miami over the next several years due to 1) an unsustainable lack of affordability and 2) negative economic shock from a deflationary recession.

The high levels of immigration in Miami might make this crash worse in the short-term given the depressive impact on wages at a time when prices/rents surged out of control.

However, over the long-term, as new immigrants into a city like Miami (or Boston, or San Francisco, or Houston) save money and become more prosperous, they will increase fundamental housing demand. And eventually cause rents and home prices to go up by more than the rest of America.

If you were to interpret this somewhat convoluted analysis as a buy/sell signal, I would say SELL Miami for the next 2 years and then BUY after that for the long-term growth (although to be clear, I am not giving definitive investment advice).

Someone intent on buying in Miami today, or a similar destination city, might also find comfort that even if there's a short-term crash, there will be a strong recovery over 5-10 years.

As far as states like Ohio and Utah, which receive fairly low shares of immigrants...I don't think this analysis pertains to them that much. They won't see the same depressive impact on wages in short-term, nor will they see the same sustained demand in long term from immigrants.

Okay. Hope you stuck with me on all of that. Let me know your thoughts in the comments below.

I'd love to hear what you all thought of this analysis. And if you are starting to see the impacts from increased immigration in your city/housing market.

-Nick

Comments ()