Houses are about to get a lot Smaller.

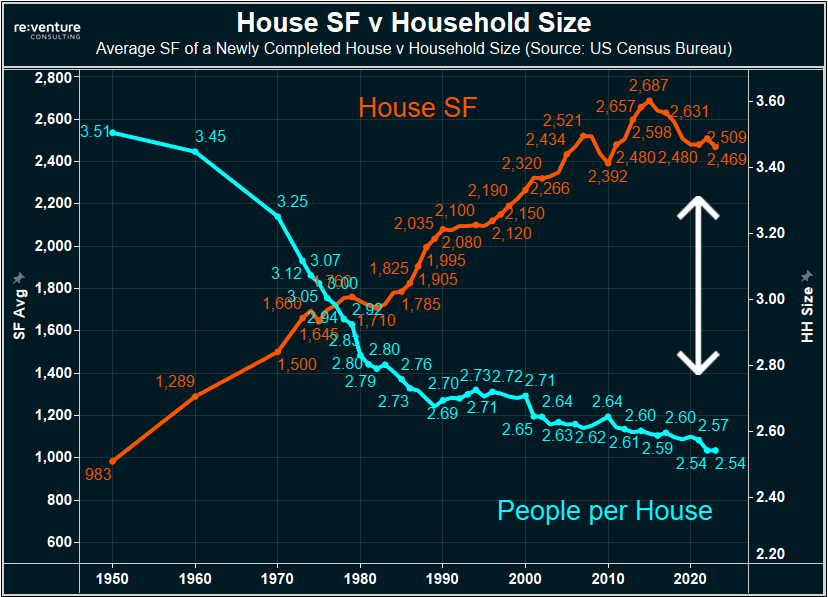

The average size of a house has increased by 250% since 1950. A trend which is now going into reverse as affordability constraints and demographic shifts cause American homebuyers to favor smaller houses.

Over the last century houses in America continually got bigger, and bigger, and bigger, with the average size of a new house increasing by an astronomical 250% from 1950 to the present day.

The 5th bedroom, movie room, and mancave in the basement became staples of the prototypical McMansion over the last 70 years, with homebuilders happy to satisfy Americans' house lust. So long as the buyer had the money (or the mortgage), the builder would build it, with the average size of a newly completed house surging from less than 1,000 SF in 1950 to nearly 2,500 SF today.

House size peaked in 2014 and has been slowly declining since

The graph above does a great job of highlighting just how big houses have become in America over the last 70 years. But if you zoom in and pay close attention, you can see another trend developing: homes have started to become smaller over the last decade.

The average size of a newly completed house declined from a peak of 2,687 SF in 2014 down to 2,469 SF today, a modest 8% drop. A drop which will likely continue well into the future due to a dramatic shift in:

1) What homebuyers can afford, and

2) the Demographic Composition of American Households

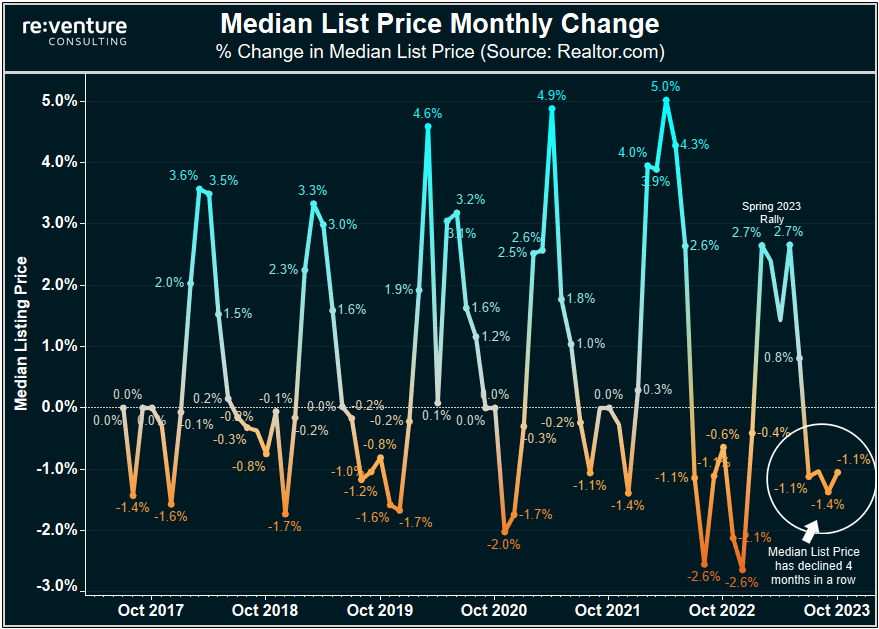

Sky-high prices to go along with 7% mortgage rates are forcing homebuyers to consider more reasonable homes because it's really all they can afford. At the same time, way fewer households are having children and more people are living alone. This cocktail is now creating stronger demand for smaller homes in America, while the McMansions are starting to linger on the market.

For instance - take this McMansion that's currently listed on the market south of Nashville. It was built in 2016 and is your prototypical "big house in the south". 6 beds, 5 baths, and nearly 5,000 SF, with a brick veneer finish and lots of dark wood on the inside.

This house has been sitting on the market for 55 days and has a mere 17 saves on Zillow, which indicates very little buyer interest. The seller has had to cut the price several times, down to $1.2 million. I bet the owner and realtor on this house think that's a decent price given that it equates to "only" $240 PSF.

However, the monthly payment on this puppy would still be over $7,500/month, or $90,000/year. Indicating that the would-be buyer of this house would need a household income north of $300,000/year to qualify for the mortgage.

Yikes. No wonder the house is sitting.

McMansions are struggling to sell because they're too big

But another major reason why McMansions are struggling to sell and builders are now cutting back on home size is a demographic one. The composition of the American Household is changing rapidly, with fewer and fewer people living in a given house.

Back in 1950, the average household size in America was 3.51 people per house. Fast forward to today and it has declined down to 2.54 people. At the same time, the size of houses has surged, meaning that more and more space in newly completed homes is going unused.

And for a while, this trend was allowed to persist, because of a certain madness that overtook homebuyers and builders in America in the last 20 to 30 years, where it became normal to build and buy way more than what's needed. One reason why this occurred is because of the "keeping up with the Joneses" effect, where homebuyers wanted to compete with their neighbors for who could have the biggest house.

But the other reason why bigger homes stayed in vogue for a long time is because of resale value. People built a perception, perhaps correct at first, that bigger homes, with more bedrooms, have a higher resale value. So if that were the case, why not always spring for the bigger house or do the addition? If you did, you were theoretically adding value and increasing your net worth.

But I think that perception is starting to change. Because more and more homebuyers don't want big houses in 2023 and some are even setting caps on the square footage for their ideal home.

More and more Americans are Living Alone and don't need big Houses

To understand why this would be, it's important to think about who is living in these houses, and how many people they are living with. We already know that on average, only 2.54 people live in a house in America.

But the average hides an even bigger shift that is occurring in the background of the US Housing Market: way more Americans are now living alone, with a record 29% of housing units being filled with a single occupant.

Back in 1950, only 13% of households lived alone. In 1990 it was only 24%.

This segment of Americans who live alone will soon account for 1/3 of occupied housing units. Many of them are seniors who are divorced or widowed. And most have little interest in a house that's 5,000 SF. Nor one that's 4,000 SF or 3,000 SF. Rather, this contingent of homeowners and renters is looking to downsize.

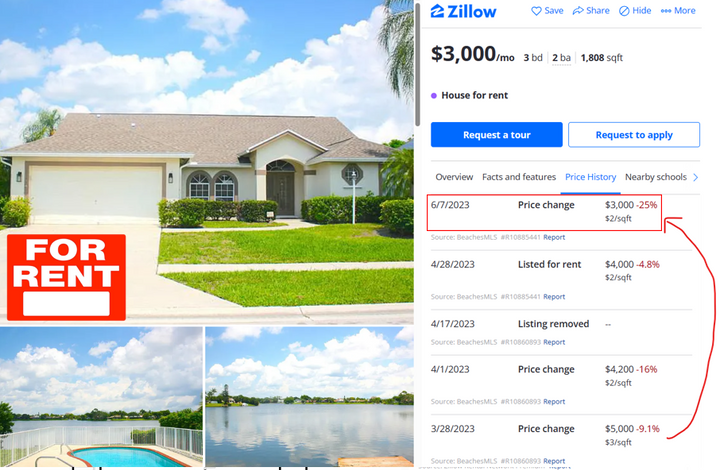

Probably to a house more along the lines of the listing below. Ranch-style, 3 beds, 2 baths, 1,900 SF, with a monthly mortgage payment of $4,500. Still way too expensive. But something that's more aligned with people's current living situations and budgets.

Americans are also having fewer children. Greatly reducing the need for Home Square Footage.

But that's not all folks. Just as more and more Americans are priced out of big houses and living alone, fewer and fewer Americans are having children, with the US Census Bureau reporting that only 26% of households have a child in it.

That's down from a high of 49% in 1960.

I mean - think about that everyone. America went from having 1/2 of its housing units occupied with a child in it to only 1/4. And now more Americans live alone than with a child in the house.

The reasons for this demographic shift are multi-faceted, with the biggest factor being the aging of America. As the median age of the population gets older, fewer people will have kids. And more people will live alone.

Concurrently - many younger Americans in the Gen-Z and Millennial Generations are choosing to prioritize career and schooling over family formation. Many people in the age range of 25 to 40 want to eventually buy a house and start a family, but they simply can't do it given their schooling and career commitments, as well as the large levels of student debt that keep them sidelined from taking out a mortgage.

Demographic Shifts will change the Housing Market forever. Smaller Homes are In.

Make no mistake - this demographic shift of fewer children and more people living alone is going to have a huge impact on the long-term trends of the US Housing Market.

For starters, this trend is likely to suppress home-buying demand in general over the long term, since the presence of a child is often the main motivating factor for an individual or family to want to own a home. Remove the child and it becomes a way easier decision to rent.

Particularly for younger people who are single or are in a DINK (Dual Income, No Kids) relationship, where it's probably more appealing to travel the world and stay in Airbnb's than to take out a mortgage and buy a house.

Meanwhile, older Americans who live alone are still likely to want to own their house. But the type of house they will want to buy will be much smaller than the footprint that has been built over the last 20 to 30 years. Probably somewhere in the neighborhood of 1,500 to 2,500 square feet and single-story.

Put all of this together and one thing becomes clear: oversized McMansions are going to go the way of the Dinosaur while smaller, ranch-style homes will be "in". The perception that bigger houses have better resale value will be destroyed.

Expect builders to follow these trends and continue to build smaller homes. Something they have already started doing, with the CEO of PulteGroup, the third-largest builder in America, stating:

“As data suggests, some first-time buyers are opting to go with less square footage or fewer options and upgrades as buyers need to purchase a home in today's dynamic market environment,” PulteGroup (PHM) president and CEO Ryan Marshall said on the call with analysts Tuesday...

The shift to Smaller Homes will take time

Of course - something to take note of if you're a homebuyer or real estate investor is that American's shift to favoring smaller homes is happening gradually and will likely take another 10-20 years to fully play out.

Moreover, one big structural plus that McMansions have is that they're usually located in very good school districts since these larger homes were built to accommodate wealthier families with more children. As a result, these way-too-large houses might still have some lingering buyer demand due to the strength of the schools that surround them.

However, I suspect over the long term, school district quality will improve in neighborhoods with smaller homes as more retirees and young couples with money decide to locate themselves there, thereby increasing demand, appreciation, and property tax revenue.

What type of House are you looking to Buy?

I'm curious: what type of house are you looking to buy? Do the points I made in this article about smaller homes being more attractive resonate with you? Or do you still want a 4,000+ SF beast that has six bedrooms and an arcade? Or is the school district the main driver and the size of the house secondary?

Let me know in the comment section below. I'm excited to hear your responses.

-Nick

Comments ()