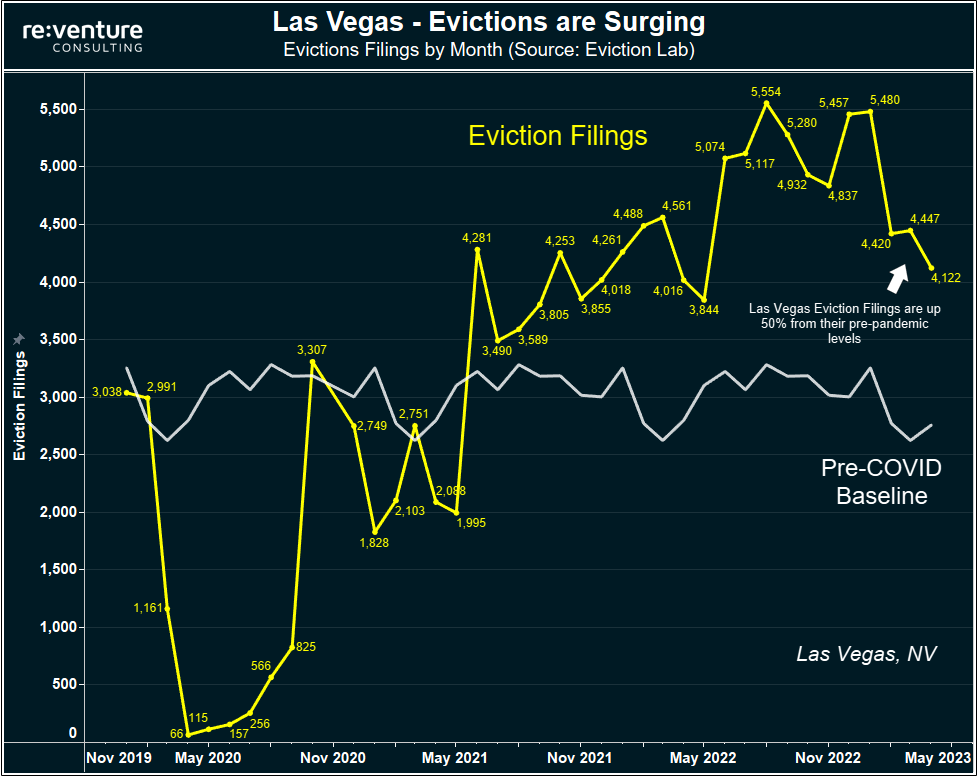

Evictions are surging. Especially in Las Vegas.

Evictions across the US rental market have surged over the last year, most notably in cities like Las Vegas, Houston, and Minneapolis where they're up over 50%.

Evictions on the US Rental Market have surged over the last year, with cities such as Las Vegas reporting eviction rates as much as 50% higher than pre-pandemic levels. These higher evictions are now starting to hurt landlord profitability, with higher vacancy rates and collection loss resulting in reduced operating income across the market.

Ultimately the "cure" for this increase in evictions is continued wage growth in the US Economy to go along with a period of stagnating or declining rents. This combination will help return affordability to the US Rental Market and reduce the chances that rent-burdened households default on their payment and face eviction.

Real estate investors should also watch these surging eviction rates carefully because they could be an "early warning indicator" of economic trouble. Particularly in cities where the eviction rates in 2023 are significantly higher than their pre-pandemic norms.

Eviction Rates are now back to pre-pandemic levels Nationally.

Data from Eviction Lab shows that evictions in the middle of 2023 are now back to pre-pandemic levels, indicating that landlords across the US are doing a "normal" level of evictions on a national basis.

This return to normal is a big departure from what occurred in 2020 and 2021 during the height of the pandemic, when a slew of eviction moratoriums set by Congress, the CDC, and local governments prohibited landlords from evicting tenants who weren't paying rent.

During this period, evictions declined by 50-60% nationally and by as much as 80% in certain cities.

These reduced eviction rates constrained the available inventory on the rental market, which created more competition for rentals, and ultimately incentivized landlords to significantly increase rents on the tenants who were paying.

But now those trends are reversing. Starting in the middle of 2022, as most of the moratoriums expired, eviction rates began to surge back closer to their long-term norms, and over the last six months landlords have been evicting tenants at a similar rate to the averages from 2016-19. A trend which is now causing more vacant rentals to hit the market and putting downward pressure on rents.

Evictions are up by 50% in Las Vegas, Minneapolis, and Houston

But looking at the national data hides tremendous variability between different cities in terms of how much evictions have increased. For instance, in Las Vegas, which I have dubbed "the eviction capital of America", eviction rates in the beginning of 2023 are 62% higher than pre-pandemic norms.

Other cities with a big increase in evictions include Minneapolis (+71%), Houston (+62%), Jacksonville (+33%), and Phoenix (+31%), where evictions just hit their second-highest level in 15 years. In terms of geographic consistency, there appears to be a heavy increase in evictions in the Sun Belt.

These skyrocketing evictions are now taking their toll on landlords in these cities, as more and more empty apartments are piling up. With data from Apartment List showing that the vacancy rate in a city like Las Vegas has surged from 2.5% in 2021 all the way up to 8.7% today.

Not surprisingly - vacancies are also way up in Minneapolis, Houston, Jacksonville, and Phoenix, the other cities with lots of evictions. A clear indication that eviction rates are a metric that landlords and real estate investors should be paying attention to.

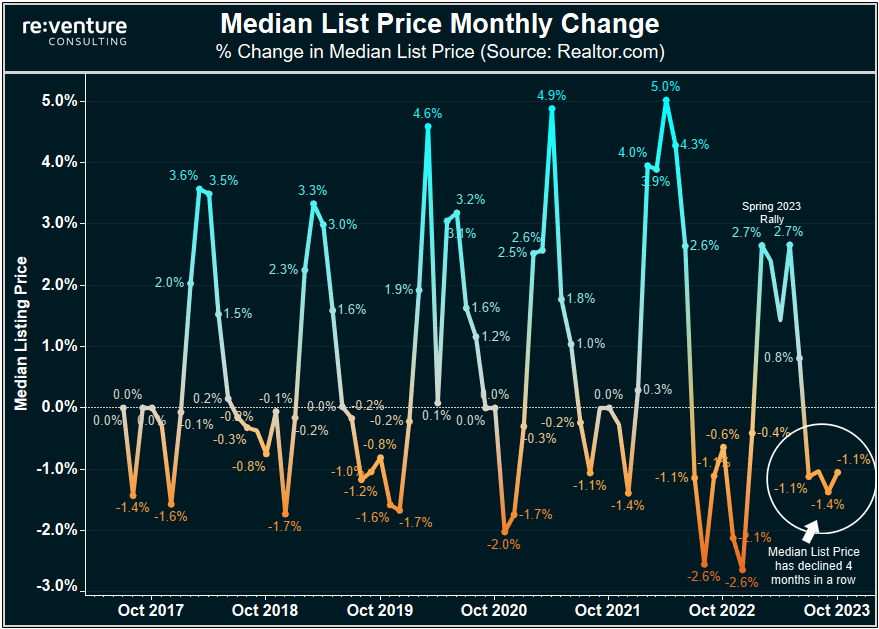

After a huge boom during the pandemic, Rents are now on the decline

At its peak during the pandemic, in late 2021, asking rent growth in the US Rental Market hit 18.2% YoY according to data from Apartment List. This surge in rents was historically unprecedented and gave landlords a huge windfall of profits even though they were losing money on some tenants who couldn't be evicted.

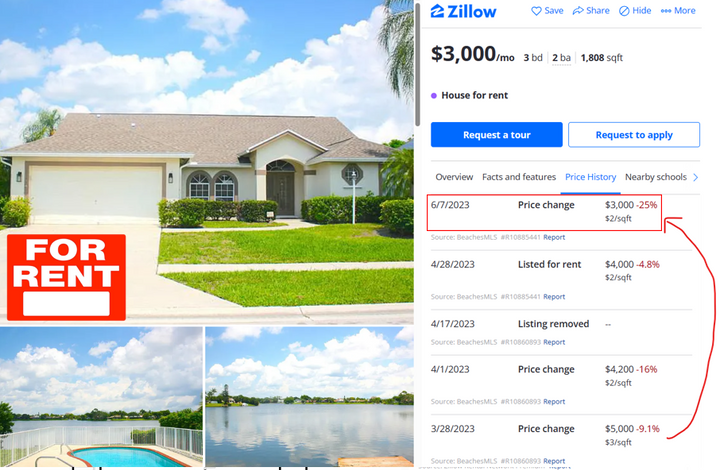

But now the market has shifted. Evictions and vacancies are up, while rents are now going down. June 2023 marked the first month of YoY rent declines (-0.1%) in Apartment List's data set since the very beginning of the pandemic when the lockdowns hit.

It's likely that rents will continue to decline in the back half of 2023 due to rising vacancies as well as rental rate affordability issues. On the graph above you can see how the yellow line, rent growth, greatly exceeded wage growth (blue line) throughout 2021 and 2022.

Meaning that over the last three years, rents in America have grown by 24% while wages have only grown by 15%. That's a trend that cannot be sustained. Eventually the wage growth will need to "catch up" to the rents. That's the only thing that will stem the tide of increasing evictions and vacancies for landlords.

The trouble is - wage growth in America is now decelerating as well, with weekly wages for workers increasing by only 3.7% YoY in June 2023, which is down from the 5-6% growth levels experienced during the pandemic. A report from ADP Payroll Services suggests that wage growth will likely continue decelerating in future months.

Slowing wage growth suggests more Evictions and Rent Cuts are Coming

I see some people in the institutional real estate space who believe the rental downturn in America has already bottomed out. And that we'll see rent growth bounce back in the second half of 2023.

However, I don't see how it's possible. Rental affordability is still poor for most renters, and it will not improve overnight with weekly wages growing at sub 4%. Moreover, there's a near record 1.1 million apartments under construction. And don't forget, it's likely the unemployment rate increases as the year goes on.

The combination of these factors suggests that landlords and real estate investors will need to cut the rent further to stimulate rental demand and fill their apartments/houses. And that evictions will continue rising as the year goes on.

Cities where Evictions are still low

However, evictions haven't increased everywhere. In fact, they are still very low in cities such as New York and Philadelphia, where local eviction rules have made it increasingly difficult for landlords to evict tenants who are not paying rent.

In New York specifically evictions are down -42% from their pre-pandemic norms while in Philadelphia they're down -31%.

Other markets where evictions remained low include Charleston (-29%), Cleveland (-21%), Richmond (-16%), and Pittsburgh (-12%). Charleston represents the only Sun Belt boomtown city where evictions are trending lower. Other low evictions markets are in the Northeast of parts of the Midwest.

How should real estate investors and landlords interpret the lower eviction rates in these cities? Well, it's a mixed story. On one hand, lower eviction levels could be a positive sign, indicating that local tenants are able to afford the rent. And that the local economy is strong.

However, if the lower eviction levels are due to government interference in the rental market, like in New York, this is not good for real estate investors. It means that in the event you run into issues with your tenant in these cities (or states, as New York on the state level has strict eviction rules) you might be stuck for months with no cash flow from a tenant who isn't paying the rent.

Ultimately this eviction data is important to track in for both understanding the direction of your local economy and rental market. If you want to track this data for yourself, head to Eviction Lab. They have monthly eviction updates for 10 states and 30+ cities.

Comments ()