$1.5 trillion Debt Crisis about to hit Real Estate Market

Commercial property values could decline by 40% over the next several years as a $1.5 trillion wall of debt hits the US Real Estate Market.

A crisis is building in the commercial real estate market, with $1.5 trillion in loan maturities coming due over the next three years. Many of these loans will turn into defaults and foreclosures in 2023, 2024, and 2025 as landlords hand back the keys on failing office buildings and retail strip centers. Morgan Stanley estimates that commercial property values could fall as much as 40% in the process.

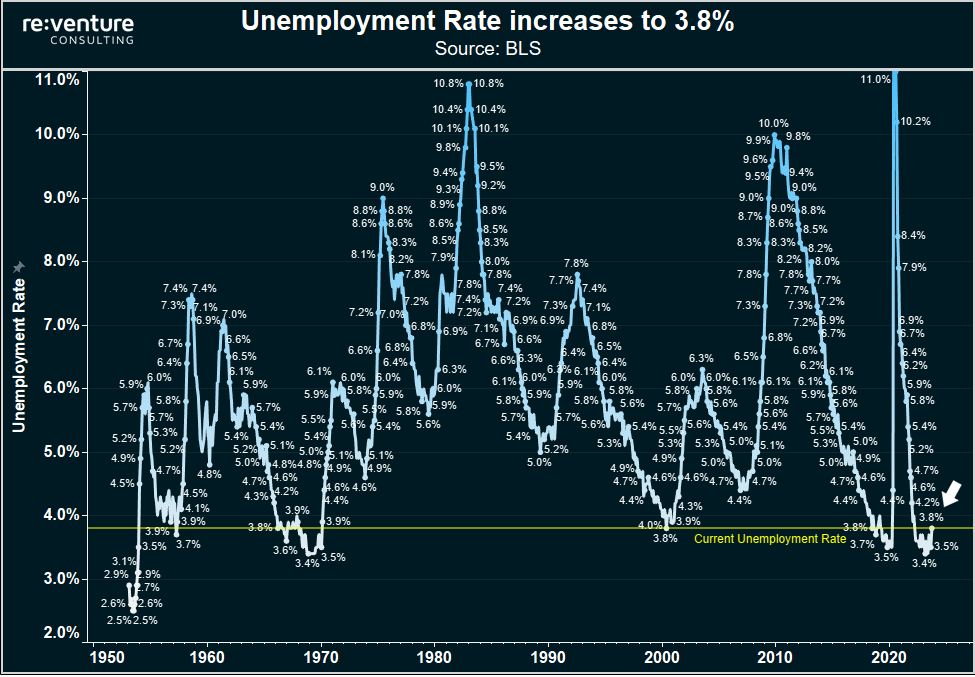

As property prices fall, the banks who originated the commercial mortgages will cut back hard on new lending, resulting in a widespread credit crunch across the US Economy. This credit crunch, which is already underway, will worsen in the second half of 2023 and trigger widespread business failures and layoffs.

This commercial debt crisis and credit crunch will have massive knock-on effects on the US Economy and Housing Market, with aggregate real estate demand declining as deflationary forces overtake the economy.

Commercial Real Estate Values already down -11% in the last nine months

Values in the commercial property sector, which includes office, retail, hotels, industrial, and apartment buildings, have already declined by 11% since mid-2022.

The biggest decline in commercial real estate thus far has come in the apartment sector, where values are down -12.5% YoY. These value declines are related to increasing expenses and declining rents, to go along with the massive interest rate hike regime enforced by Jerome Powell and the Federal Reserve.

Retail strip centers have declined by -7.4% while office buildings are down by -8.9%. Industrial has been the best-performing sector with prices only down -2.3%. These value declines are likely the first in a series of drops that will occur over the next several years as the recession worsens and the debt crisis intensifies.

$1.5 trillion "Wall of Debt" coming over the next three years

The main problem in commercial real estate is that these declines in property value are now intersecting with a wave of maturing debt (a $1.5 trillion "Wall of Debt").

Data from MSCI shows that there is $390 billion in commercial debt maturing in 2023, to go along with $495 billion in 2024 and $465 billion in 2025. These are big figures which are about to wallop US credit markets, particularly banks, who hold about half of this expiring debt.

And we're already seeing landlords begin to walk away from this maturing debt. Brookfield Corporation, one of the world's largest investment management companies (think of them as the Canadian version of Blackrock), just defaulted on a $161 million mortgage collateralized by office buildings in Washington DC.

The default was prompted by a double whammy of 1) tenants moving out of the building in a post-pandemic world and 2) the interest cost on the mortgage more than doubling over the last year due to Fed Rate hikes.

Among the dozen buildings in the Brookfield portfolio with the $161.4 million debt, occupancy rates averaged 52% in 2022, down from 79% in 2018 when the debt was underwritten, according to the report. Monthly payments on the mortgage’s floating-rate debt jumped to about $880,000 in April from just over $300,000 a year earlier as the Federal Reserve raised interest rates.

Meanwhile, Westfield Group, the shopping center company, just stopped making interest payments on a downtown San Francisco mall collateralized by a $550 million mortgage. They are handing it back to their lender.

Small banks are about to get crushed by Defaults

The issue for these lenders on the Washington DC office buildings and San Francisco mall is that they will have to significantly write down the asset value of the properties on their books. And potentially by a lot (e.g., lenders on a St. Louis office building lost 95% of their investment when it sold at foreclosure in 2022).

Writing down the asset value will force lenders, particularly banks, to recognize losses on their income statement and balance sheet, which will constrain their ability to issue new loans. It might also trigger concern among their depositors that the bank is not financially sound and it could trigger bank runs.

This is especially true for small banks, who hold $1.9 trillion in commercial real estate loans in 2023, which is more than two times the number of large banks. Even more concerning, small banks have been increasing their exposure to commercial real estate loans over the last five years.

Small and regional banks have so much exposure to these commercial real estate loans that they comprise 37% of their customer deposits. By comparison, commercial loans only account for 8% of the deposits at large banks.

Small banks have $5.2 trillion in deposits on their books right now, down about 4% from since the Silicon Valley Bank Crisis hit in March 2023. Meanwhile, they have $1.9 trillion in commercial real estate loans, accounting for 37% of their deposits. Such high deposit exposure to commercial loans means that there could be big issues for these small banks as landlords continue to default on mortgages (don't be surprised if there's more bank runs in the second half of 2023 and 2024 as a result).

Why Commercial Real Estate is more exposed than Residential.

Commercial Real Estate is more exposed to this debt crisis than Residential because of how commercial real estate loans are issued, particularly the length of their terms.

Residential mortgages in America are typically 30-years and have low "refinance risk" as a result. Comparatively, commercial loans are usually issued for 5 or 10-year terms. Meaning that they come due more quickly.

So now all these commercial real estate loans issued during the ultra-low interest rate period of the 2010s and the pandemic are needing to be refinanced in an environment where interest rates have surged, with the 1-year US Treasury up to its highest level in two decades at 5.4%.

That means that many of these commercial properties, whether it be an office building or apartment, will immediately be losing money for these landlords if they refinance at prevailing interest rates. Which creates a huge incentive to default.

Moreover, there are secular issues that are hitting the commercial property sector, particularly office and retail. In the case of office, work-from-home is here to stay, with in-person occupancies still only 50% of their pre-pandemic level.

Meanwhile, retail is dealing with a secular shift away from buying in stores and more to buying online, with e-commerce now accounting for 15% of total retail sales (up from 10% before the pandemic).

Prepare for years of issues in Commercial Real Estate that hurt the Economy

Office and retail are going to take it on the chin. Apartments and multifamily will also get hit hard given how low cap rates are and how high interest rates are today. The result will be years of distress occurring in the commercial real estate sector, which will spill over into the real economy in the form of a banking credit crunch that deprive businesses of liquidity and capital.

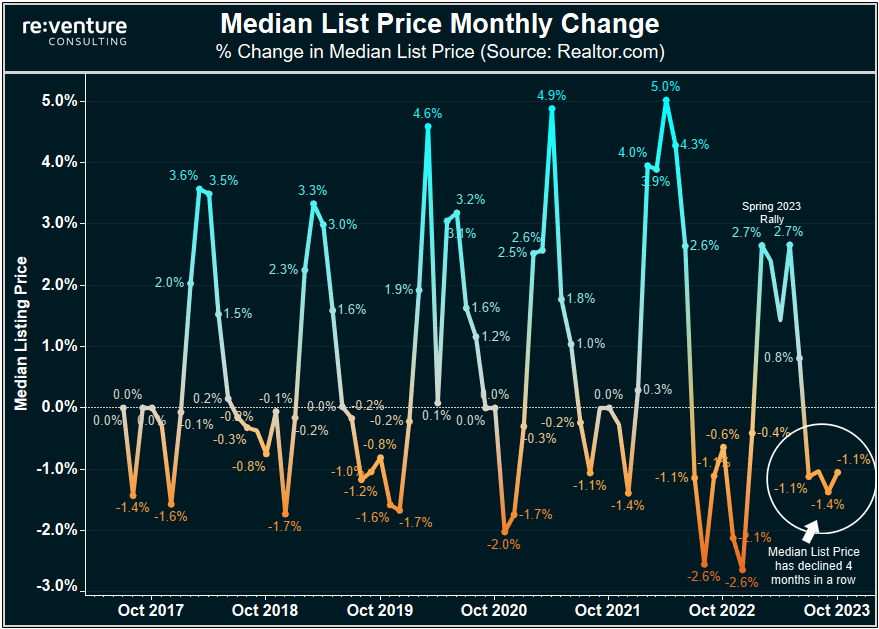

The result will likely be deflationary forces in the economy that cause the unemployment rate to spike and the prices of goods and services to decline (particularly, real estate).

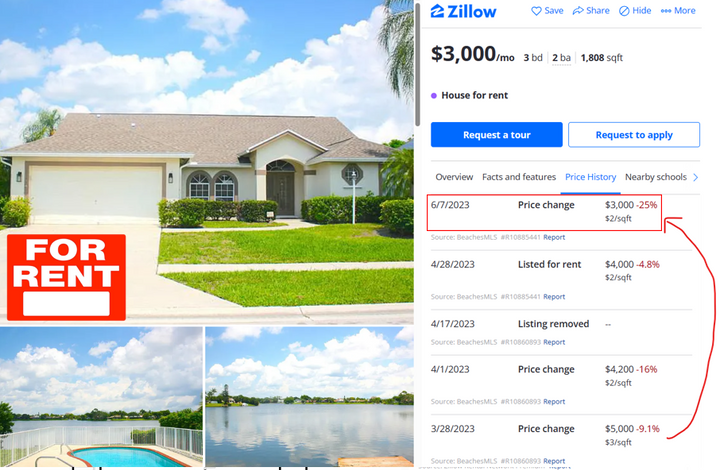

I believe the residential Housing Market will get hit in a tangential way, with the economic turmoil caused by the commercial real estate debt crisis causing layoffs and bankruptcies that induce forced selling of homes.

Watch out for this story over the next year. Because it is just starting now. And it will continue to worsen.

-Nick

Comments ()