Austin, TX in Free Fall. Home Prices Continue to Drop.

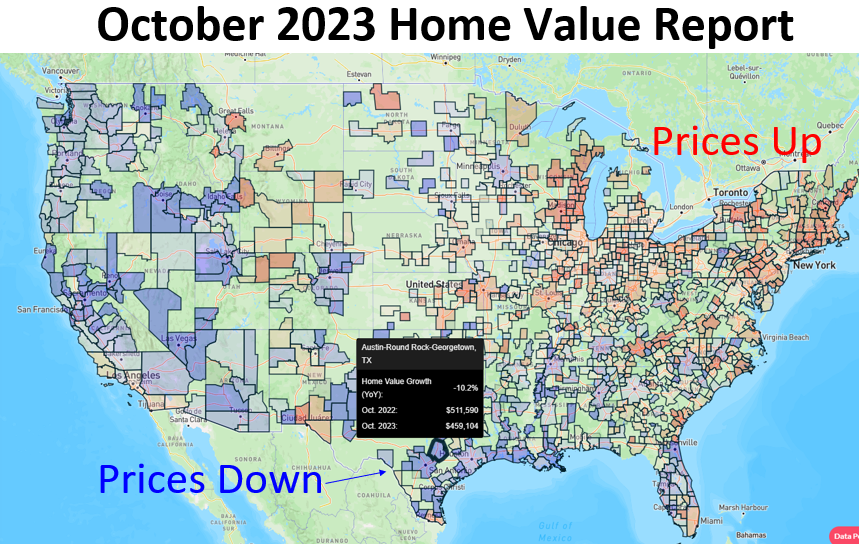

Home Prices continued dropping fast in Austin as well as other parts of Texas in October 2023. Meanwhile, home prices kept surging in the Northeast.

Zillow's October 2023 Home Value data just came out this week. And the results reinforce a trend that we've continued to see in the Housing Market since mid-2022: home prices are declining on the West Coast and Texas, but are continuing to increase in the Northeast.

Once again, Austin, TX led the way in price declines registering a hefty -10.2% drop in home values over the last 12 months. Coming in second place, somewhat surprisingly, was New Orleans, which registered a -8.5% decline. Boise, ID came in third at a -6.3% YoY decline.

With the rest of the list being a "who's who" of West Coast markets that boomed during the pandemic but are now experiencing a gradual deflation of their Housing Bubble, including Las Vegas, Phoenix, Reno, Provo, Sacramento, and Stockton. Home Values in these markets declined anywhere from 3-5% over the last 12 months.

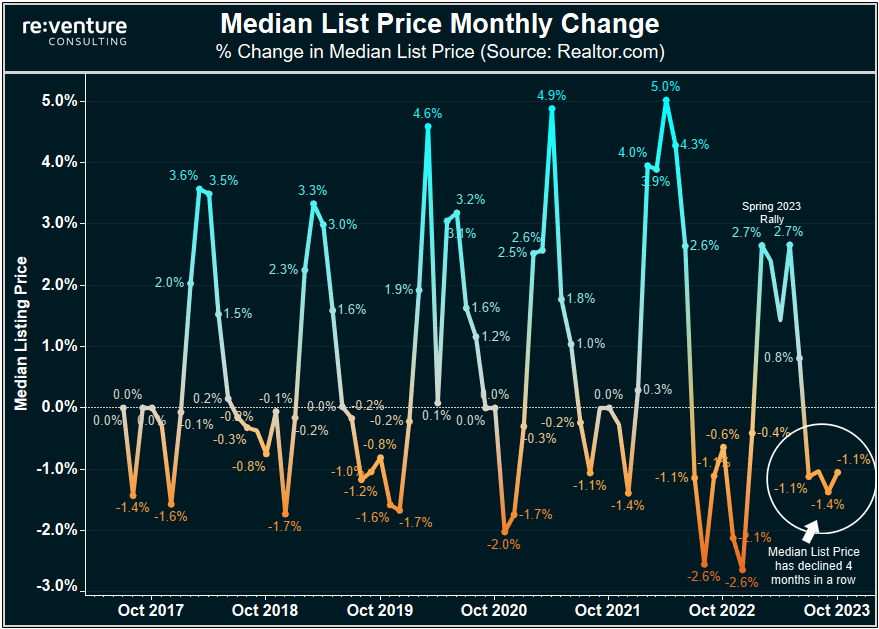

Month-over-month drops biggest in Texas

Another way to view this data is by looking at the month-over-month changes in prices, which give a more "real-time" measure of the trends in the housing market. You can access this monthly data on Reventure App by selecting the 'Home Value Growth (MoM)' data point.

Here we see a very clear story developing: Texas is the Housing Market that is getting hit hardest right now (to go along with Louisana).

With 7 of the top 10 metros experiencing the largest monthly price declines being situated in Texas. They include Beaumont, Laredo, Austin, Waco, San Antonio, College Station, and Killeen, which all registered a monthly drop of over -0.30%.

I warned of trouble brewing in Texas' Housing Market back in July when I noted a combination of surging inventory and declining homebuyer competition in my preliminary inventory analysis. Now those warning indicators are proving prescient and resulting in declining home prices.

These Home Value Declines could get a lot Bigger

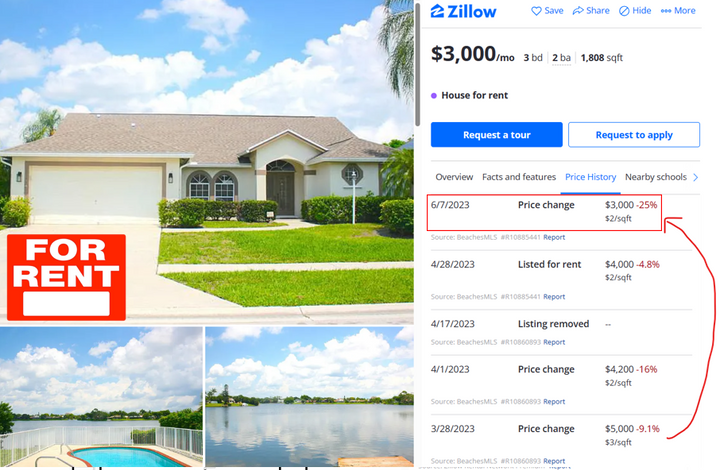

But those paying attention to the Housing Market in many of these cities will understand that these declines likely "underrepresent" what is occurring in the market right now on certain listings.

For instance, in Austin, TX, it has become commonplace to see sellers reducing the price of their homes by 20-25% (like on the listing below). Indicating that the real-time decline in values, for at least some homeowners, is getting quite severe.

As a result, don't be surprised if the home value statistics released by Zillow, as well as other sources like Case Shiller, start to decline more significantly in future months as the recent spat of price cuts and listing reductions makes its way into the data.

Top 10 Cities where Home Prices are still Going Up

With that said - what are the areas in America where home prices are still increasing? And increasing quite substantially? Well, as I said at the beginning of the article, these metros are primarily concentrated in the Northeast and Midwest.

In particular, Hartford, CT clocks in as the #1 home value growth metro in America, registering a 10.5% appreciation rate over the last 12 months. Coming in second place is Trenton, NJ, clocking in at 10.0% growth.

We should just take a second to appreciate how Hartford and Trenton, two housing markets that no one really cares about or focuses on (at least on an institutional investor level), are now experiencing the fastest appreciation in America. Registering double-digit price increases at a time when home-buyer demand is at its lowest level in decades.

Moreover, Hartford and Trenton have fairly reasonable Home Value / Income Ratios (sub <4.0x) and aren't too overvalued (only around 10%). As a result - could these areas actually be good places to buy for a real estate investor right now?

(To go along with Rockford, Rochester, New Haven, and Syracuse, the other Rust Belt towns that made the top 10 growers list?)

Well - I wouldn't necessarily go that far. These high-appreciation metros all have their problems, namely related to high property taxes and heavy outbound migration. At some point, the appreciation train will likely slow, and slow big-time.

But for now, they're the top performers. And it's their relative affordability (aka low Value/Income, lower Overvaluation) that's driving it. So if an investor wants a "safe haven" to buy real estate, perhaps purely as a long-term inflation hedge, these metros might do the trick. Just don't expect much real growth in the long run.

Accessing Home Value Data on Reventure App

Home Value data on Reventure App is now updated through October 2023, with associated premium data points like overvaluation % and cap rate also updated. Make sure to log onto Reventure App and see how the Home Value trends shifted in your market in October.

Going forward - Home Value data and associated premium data points will be updated in the middle of the month, for the prior month (meaning that the November 2023 value update will come in mid-December). I will be watching the November 2023 results closely because I expect they will begin to show the declines we are beginning to see anecdotally right now.

Also note: we will be adding a "monthly data" button to the graphs on Reventure App soon so premium users can see historical data on a monthly basis rather than just annually. I'm hoping that will be ready by the end of the month.

Talk to you all soon.

-Nick

Comments ()