New ADP Jobs Report is not good. Recession continues in Tech & Finance.

ADP just released their May 2023 job report today and the report was not good. It showed continued layoffs in high-pay industries like tech, finance, and manufacturing. To go along with heavy job losses in the South.

These trends suggest that the US Economy, and by extension the Housing Market, will struggle into the future.

Let's breakdown this report in detail so you can understand the truth behind what's happening in the economy.

Headline +278,000 job growth looks good. But is Misleading.

The headline job growth figure reported by ADP this month was +278,000 in total. Which looks pretty good considering it beat the long-term average monthly growth rate of +200,000 going back to 2010.

From this high-level perspective, it would appear like the US economy is still growing. And that there is no recession. A narrative that mainstream financial reporters like CNBC and MarketWatch are latching on to.

However, a big problem surfaces when you start dissecting the jobs data in detail. And particularly, when you start breaking down the composition of industries where job growth is occurring in.

With a clear, unsettling trend now emerging...

America's job growth is becoming increasingly confined to low-pay industries. Most notably, the Leisure & Hospitality sector which comprises restaurants, bars, and hotels.

The Leisure industry added a hefty 208,000 jobs in May, accounting for a massive 75% of the month's total job gains. Other industries that also added jobs were Natural Resources, Construction, and Trade. Overall, 5 of the 10 industries ADP tracks added jobs on the month.

But at the other end of the spectrum were industries like Manufacturing, Finance, Information, and Professional Services. Which all lost jobs. These industries tend to have higher pay. With their continued job losses reflecting the White Collar Recession that is occurring in America right now.

The White Collar Recession in 2023

And this White Collar Recession wasn't just a May thing. It's been an entire 2023 thing. With all those layoffs you've been reading about at companies like Amazon, Google, and Meta finally starting to show up in the payroll figures from ADP.

You can get a better sense for the White Collar Recession on the scatter plot below. If you first focus on the bottom right, you see industries such as Information, Professional Services, and Financial Activities. These industries all have fairly high Median Pay (x-axis) and have all lost jobs thus far in 2023 (y-axis).

Meanwhile, in the top left, you can see Leisure & Hospitality. Which has added an insane +607,000 jobs on the year, good for 65% of America's overall job growth. Very clearly, leisure jobs are "driving the bus" on the economy right now.

But the issue is they won't be able to drive the bus for long. Because the median annual pay for leisure jobs is only $33,000/year. By far the lowest of the 10 industry segments tracked by ADP.

Indicating that the consumer spending power of these job gains will be minimal. And will not be enough to offset the consumer spending declines that are coming from job losses in high-pay industries.

61% of Consumer Spending comes from high-income Households

It's very much a tale of two economies right now. The high-income, white-collar worker is experiencing a recession. The low-income, blue-collar worker is not.

The trouble is - it's the white-collar worker who actually does drive the bus on the economy. With Bank of America reporting that high-income housheolds account for over 61% of consumer spending.

Meanwhile, the lowest two income quintiles, who likely correspond to whose being hired in the Leisure & Hospitality sector right now, only account for 22% of consumer spending.

This suggests that the downward trajectory we've seen in consumer spending over the last several months will continue throughout the rest of 2023. As high-income households get laid off and cut back.

The danger here is that eventually these declines in spending, which so far have been confined to the goods economy (furniture, luxury fashion, and clothing) will eventually spill over into the services economy (restaurants, hotels, airlines).

If that happens, then all bets are off. The job gains we've seen in Leisure & Hospitality will evaporate. The same with Trade and Transportation. And it will become very evident that America is not just in a White Collar Recession, but a Full Blown Recession.

The South continues to Lose Jobs

One interesting wrinkle in this jobs data from ADP is related to the location of where jobs are being added/lost.

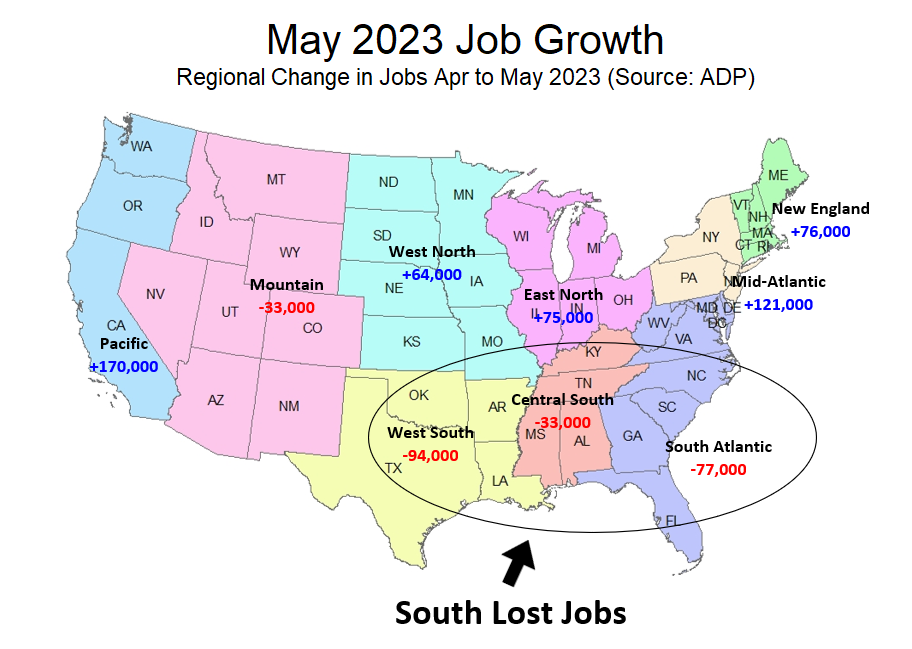

Specifically, it looks like the Southern states are the first to see meaningful job losses in this Recession. With regions covering Texas, Arkansas, Tennessee, Georgia, and Florida registering hefty job losses in May 2023.

Meanwhile, the Eastern and Western coasts continued to add jobs at a robust pace in May. With the Pacific region covering California, Oregon, and Washington leading the pack at +170,000.

These regional disparities track with the industry trends. Because it was the Northeast and Pacific that lost the most leisure jobs during the pandemic. And now that the world has normalized, and tourism to these areas is returning, the leisure jobs are being "added back".

You can see that America has 16.4 million total leisure jobs right now according to ADP. That figure is right around the previous peak in 2019. But well below the trend that America was on prior to the pandemic which suggested 17.5 million by 2023.

The gap between trend and current jobs means we could continue to see more strong headline jobs figures in future months as low-pay industries in the Pacific and Northeast add back jobs to get closer to the pre-pandemic trend.

Some people will misinterpret these headline jobs figures as the sign of an economic "recovery". And think that the US is not in recession. However, that interpretation would be incorrect. Rather, these areas are simply getting back to normal.

A normal that will likely get destroyed again later in the year as overall consumer spending continues to contract.

Watch the South. It will signal a lot of things about the future of Economy & Housing Market.

States like Florida, Texas, and Tennessee didn't have much of an economic downturn during the pandemic. So they have less "catching up" to do in terms of leisure employment. Which is why these areas are the ones showing the first aggregate job losses in the Recession.

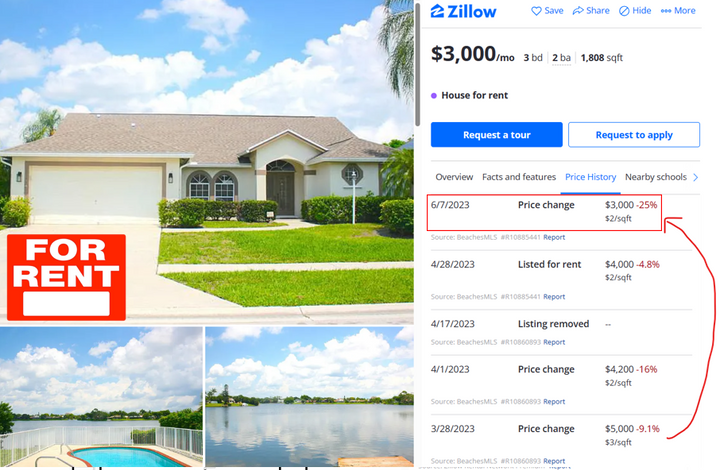

This economic contraction could hurt the South's Housing Market. Because home prices boomed here the most during the pandemic. With home builders responding by going crazy and pulling tons of permits for new homes and apartments. Pushing the total housing construction pipeline in the South to nearly 800,000 units in April 2023, the highest level on record.

This means there really is "no room for error" in the South's Housing Market. If the job growth continues to go negative, expect a lot of empty apartments, declining rents, and seller price cuts later in 2023.

One last thing - Wage Growth is Decelerating

The other big conclusion drawn from this month's ADP Jobs Report is that wage growth in America is heavily decelerating. Particularly among people who change their job.

According to Nela Richardson, ADP's chief economist:

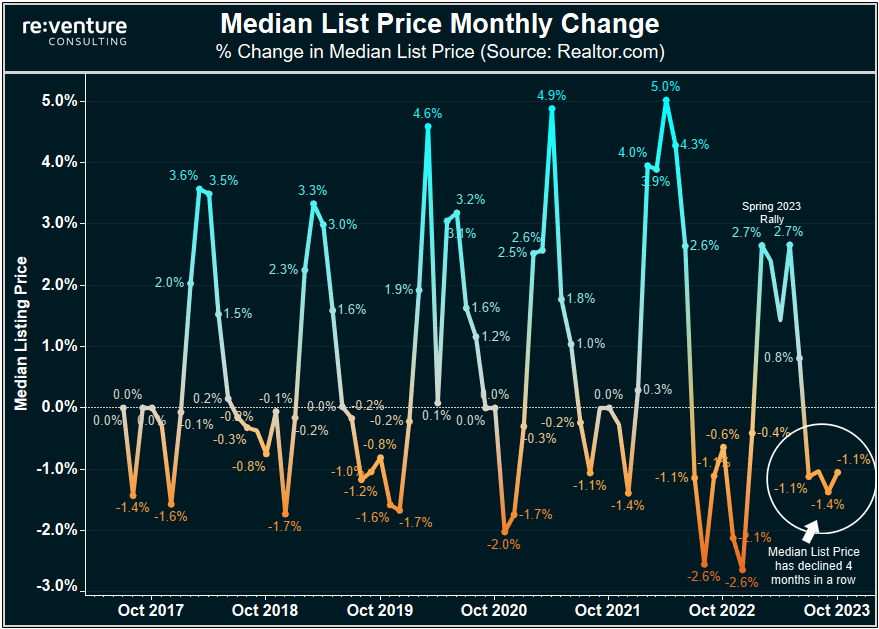

"Pay growth is slowing substantially" is a big problem for the US Housing Market. Because the only hope of home prices and rents sustaining themselves at record levels was is if we entered a wage-price spiral a la the 1970s. Where household incomes kept increasing and increasing, bringing more affordability to the market.

However, according to ADP it doesn't look like that's happening. A finding supported by Bank of America's May 2023 consumer checkpoint, which also showed heavily decelerating wages. And by recent data from the BLS which showed that wages contracted in America at the end of 2022.

There was nothing Bullish about this Jobs Report

Economic and Housing Market Bulls are likely pumping their chests after this jobs report because they saw the +278,000 headline growth figure. And thought it meant that we're not in a Recession that and housing demand will increase.

But those who read into figures know the truth.

That the White Collar Recession is getting worse. That the South is losing jobs. And that pay growth is worsening. Trends that will likely weigh down on the broader economy and housing market later in 2023.

-Nick

Comments ()