5 Cities that are still safe for Real Estate Investors in 2023

High home prices and interest rates make it difficult to be a real estate investor in 2023. However, these 5 cities still offer decent value to investors looking for cash flow and stability.

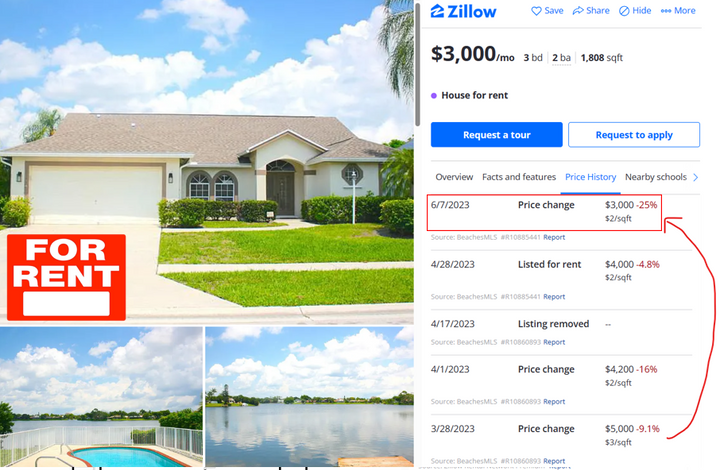

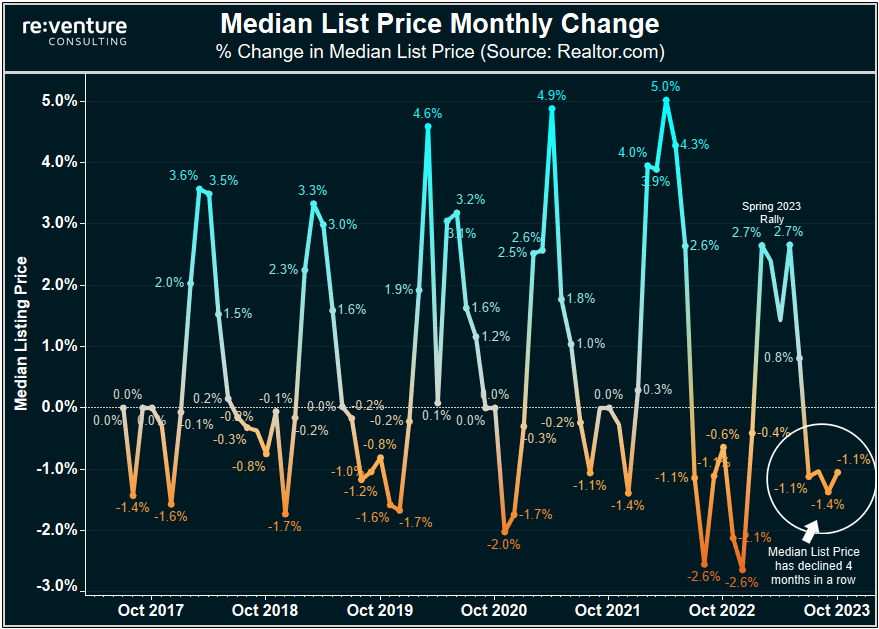

It's tough being a real estate investor in 2023. Rents are on the decline, interest rates are surging, and home prices are still high, making it difficult to find worthwhile properties to buy.

But there is some good news. Despite those secular headwinds, there are certain cities in America that offer real estate investors value and stability in 2023. These are cities where 1) cap rates are high, 2) property taxes are low, and 3) population growth is strong.

Moreover, these are areas where home prices aren't terribly over-valued, providing capital protection in uncertain times with both a Housing Downturn and Recession in the offing.

In this post (and video) I will discuss my methodology for targeting safe investment markets in 2023, as well as reveal the 5 cities I think will perform best for real estate investors over the next several years.

Step 1: cash flow just became a lot more important.

The dramatic surge in interest rates over the last year, with the cost of a mortgage now hovering around 7% and short-term US treasuries yielding over 5%, has highlighted the importance of cash flow in buying real estate.

No longer is it acceptable to overpay for an investment property and accept a minimal return from Day One. Rather, investors buying in 2023 need higher cash flows to pay the increasing cost of debt service and to offset the opportunity cost of investing in bonds.

For instance, buying a risk free 1-Year US Treasury currently yields an investor 5.2%, a return which is higher than the Rental Profit an investor earns when buying the typical house in America in 2023. Meaning that the opportunity cost of buying rentals is negative compared to buying short-term US government securities.

This negative opportunity cost is one reason why real estate investor purchases plummeted by 49% YoY in the first quarter of 2023 according to data from Redfin. Simply put - it's not worth it for most investors to buy in today's market. Why take on the headache of operating a rental and the associated risks of vacancy, evictions, and rising property taxes when you could wait for the market to correct and earn a similar return in risk-free bonds?

Step 2: target higher cap rate markets.

However, not all cities are like this. Some still offer fairly high rental profits (aka, cap rates) that exceed what you can earn on US Treasuries. In some cases, these returns also exceed the cost of mortgage debt.

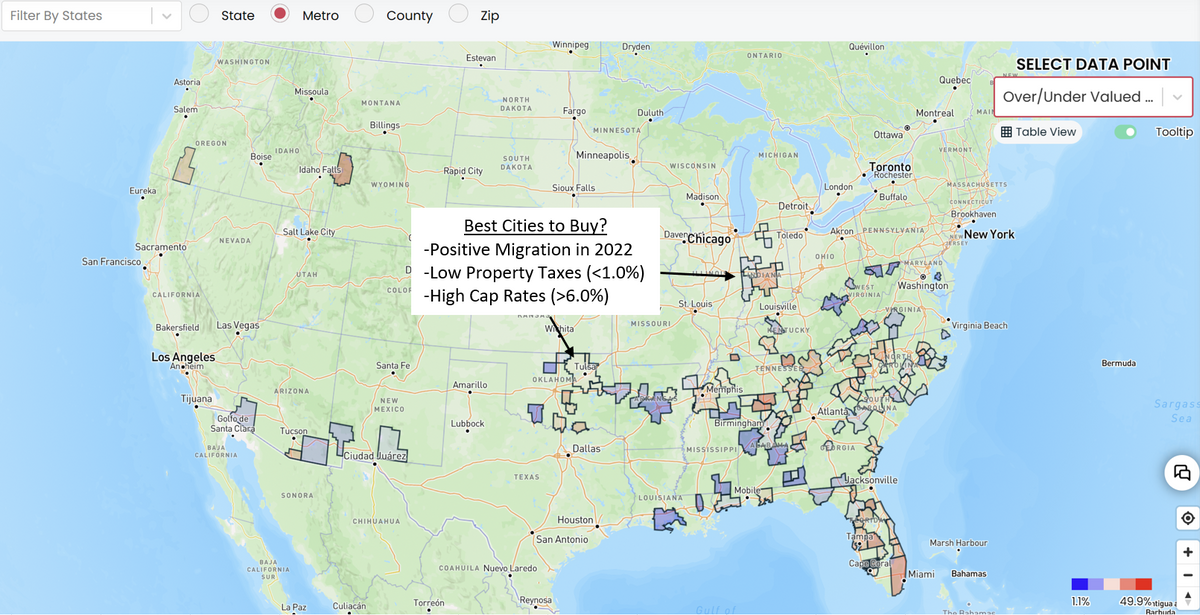

Reventure App provides homebuyers and investors access to current and historical Cap Rate data for the 400 largest metros in America. On the map below you can see these Cap Rates color-coded, with metros in red providing higher returns.

What immediately jumps out is that the highest Cap Rate markets in America are primarily situated in the Southeast and Midwest areas of the country, where returns can run anywhere from 6 to 10%. Meanwhile, on the West Coast of the US, returns are usually only 3-4%.

One interesting market that offers investors higher returns is Greensboro, NC, where the typical home value is $239k compared to estimated net rental income of $17k. The result is a 6.9% unlevered return for investors across the market as a whole (these returns can differ depending on the type of house you buy and the micro location).

Comparatively, a market like Sacramento, CA only offers investors a 4.2% cap rate. Sacramento's cap rate is lower because home prices there are 135% higher than Greensboro while net rental income is only 45% higher. Investors in Sacramento will struggle to earn a worthwhile return without huge levels of rent growth and appreciation into the future.

Step 3: cheaper prices and lower property taxes = higher returns.

There's an old expression in real estate: the one thing you can never change is the price you pay. Meaning that the same property, in the same location, could be a good or bad buy depending on what you pay for it.

And the advantage that high cap rate markets like Greensboro have is that the prices are lower. Meaning there are higher returns from the outset and greater "margin for error" into the future for investors.

For instance, say you buy in Greensboro and the market has a correction and doesn't appreciate much over the next five years. That wouldn't be ideal. But ultimately, it's not the end of the world, because you've been clipping a 7% return from Day One. Meanwhile, in Sacramento, a further correction in prices and rents could be devastating to your investment given the lower initial returns.

The other factor that plays into this calculus is Property Taxes. Low property tax rate markets have a built-in advantage for investors because again, they increase the money going back into your pocket from the start.

Reventure App also provides investors data on estimated Property Tax rates for every state, metro and county in America. These rates are calculated through ACS Data from the US Census Bureau based on what actual homeowners are paying each year. They show that Property Tax rates are lowest in the Southeast and Mountain areas of America (blue) and are highest in the Northeast and Midwest (red).

One state that has sneaky-high property taxes, and thus is not as advantageous for investors, is Texas, where homeowners are paying 1.74% of their home's value to the tax collector each year. This figure is likely even higher for investors in the state, who do not benefit from the local homestead exemption.

To put that into perspective - if you were to own an investment property in Texas for 30 years, you would pay over 50% of your initial purchase price to the tax collector over that time frame.

Step 4: what about population growth?

Now, there is a one issue with targeting high cap rate markets with low property taxes. And it's that many of the resulting cities will be of the lower growth variety. After all, many of them are cheap for a reason, and that reason is that there aren't too many people moving in.

The trick here is find the cities that have high cap rates, low property taxes, AND positive population growth. One way to do this on Reventure App is by adding a filter for Migration %, which tracks the growth in migration in a metro in 2022 as a percentage of its total population. Metros with a Migration % above 0 experienced growth.

And sure enough - when adding the Migration % filter, the remaining list of metros that fit the criteria as good places for investors to buy in 2023 is whittled down quite a bit. We can see at this point the cities are almost universally located in Southeast with Oklahoma and Indiana also tossed in.

5 Cities where it's still good to buy Real Estate

Some additional filters that might be worthwhile to apply include a limitation on how overvalued the housing market is (Over/undervalued %), as well as a limitation on home building (Permit %), and a minimum population size.

After applying these additional filters, I was left with the following cities that still rank as decent places to buy real estate in 2023:

- Birmingham, AL

- Tulsa, OK

- Columbia, SC

- Greensboro, NC

- Little Rock, AR

- Tallahasee, FL

These cities are an interesting mix of college towns and state capitals. Encouragingly, they have all managed to keep appreciating through the initial stages of the housing downturn. They also rank towards the top of the table for rent growth.

Of course - their continued success is not a guarantee. I wouldn't be surprised if home prices correct in these areas over the next couple years because they are still somewhat overvalued.

Moreover, there is going to be huge variation in how different neighborhoods within these cities perform going forward depending on their investor exposure, poverty rates, and mortgage defaults. Some of these cities also struggle with crime, which might be an additional point of concern for some investors.

Step 5: do more research.

I would encourage you to try out the Filters section on Reventure App so you can fine tune the data to find the cities that best fit what you're looking for in an area to buy a home or investment property. The use of Filters on Reventure is free for limited time.

Additionally, you can use the filters section at the ZIP code level in your metro to do more targeted research.

Very soon data on Cap Rates and Rents will be available at the ZIP code level. Also note that in the next couple months the filters section will go behind a paywall on Reventure App. I am in the process of figuring out exactly which features will be premium, and which will be kept free, so stay tuned for updates on that into the future.

-Nick

Comments ()