10 Cities where Home Prices are still Booming

The Top 10 Cities where Home Prices are still booming in the 2023 Housing Market. These areas, located across states like North Carolina and Tennessee, have managed to keep their housing market growing amid a national housing downturn.

We're now over one year into this Housing Downturn and the results thus far have been varied. Some cities have gotten hit fairly hard by price declines, while others have traded sideways, while others have continued to boom.

This post will explore the latter of those and 1) identify the 10 cities where home prices have gone up the most over the last year and 2) explore why prices have managed to keep growing in these cities during the initial stages of the downturn.

For the purposes of this post, I define a metro as "booming" if home prices have increased by more than 5% over the last year, from June 2022 to 2023, according to Zillow's Seasonally Adjusted Home Value Index ("ZHVI").

I think some of you will be shocked by the results. I know I was. The best-performing Housing Markets in 2023 are not the ones most people expected. And they're performing well for some very specific reasons that homebuyers and real estate investors need to pay attention to.

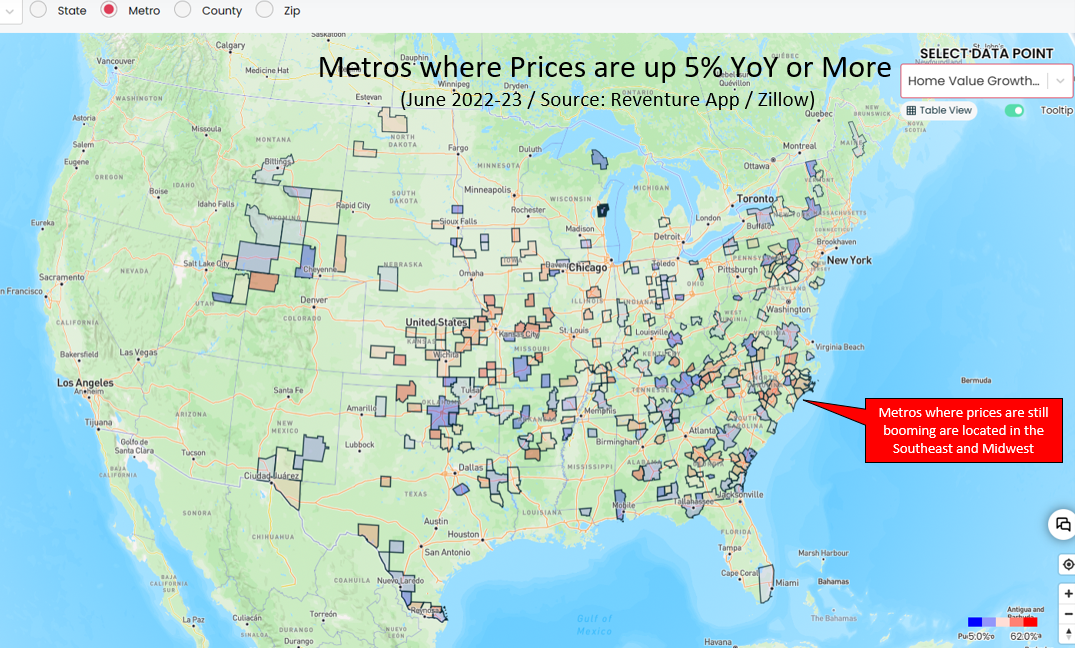

Looking at a Map View of Cities where Home Prices are still Booming

First things first - let's get a map-based view of where home prices are still booming in America. And to do that I used Reventure App to filter metro areas where prices have gone up by more than 5% YoY.

The results of the filter show a clear geographic trend: the best performing Housing Markets in America right now are universally located in either the Southeast or Midwest (with a little Northeast Rust Belt thrown in for good measure across New York and Pennsylvania).

In particular - you can see states like Oklahoma, Kansas, Georgia, and North Carolina have the strongest clusters of metros where home prices are still growing.

Meanwhile - at the other end of the spectrum - is the West Coast of America. Where the map is completely blank save for some areas in Wyoming. Home prices on the West Coast - in states like California, Arizona and Nevada - have declined over the last year, and likely have more downside left given how expensive these housing markets still are.

Which leads us to lesson #1 in understanding why certain metros are still booming: affordability means everything in today's housing market. Even with mortgage rates north of 7%, there are still cities that provide value to homebuyers on a budget. And those cities are the ones performing the best right now.

Let's kick out small Housing Markets.

Now one small issue with the map above is that includes lots of very tiny metros. We're talking places with populations below 50,000 people. Which might sound nice to some of you at first who are looking for a retirement getaway or 2nd home. But ultimately you want to be cautious buying real estate in metros that are too small, because these areas have more underlying volatility and risk.

Rather - let's focus on metros that have a minimum population size - let's say at least 200,000 people. Applying this population filter on Reventure App allows homebuyers and investors to see areas that have more stability and a decent sized economy.

With the resulting map showing much more clearly defined results. You can see the concentration towards North Carolina, South Carolina and Eastern Tennessee has now become more evident. As well as the Midwest cluster originating in Kansas and heading down to Oklahoma.

Along with a separate cluster forming on the Texas Border.

Top 10 Cities where Home Prices are Booming

Let's switch from evaluating these cities on a map, to actually viewing what these cities are and how much home prices have increased. You can accomplish this on Reventure App by hitting "Table View" on the top right of the screen, which will convert the map to a sortable list of cities.

And voila - we can now see where home prices are growing the most over the last year. With the little-known metro of Fayetteville, NC taking the #1 spot with an impressive 11.5% YoY appreciation rate over the last 12 months.

Fayetteville, NC is a military town that houses one of America's largest military bases - Fort Liberty (previously named Fort Bragg) - that houses nearly 30,000 military personnel.

This trend of military towns crops up several times on this list, with nearby Jacksonville, NC coming in at #3. Jacksonville, registering 9.2% appreciation, is located on North Carolina's Atlantic Coast and is home to Camp Lejeune, a Marine Corps training facility.

It's interesting how a little-known military town like Jacksonville can be one of the best-performing housing markets in America in 2023, while nearby Raleigh, a vaunted tech hub, has seen home prices decline by -2.5% over the last year.

Now, to be sure: most homebuyers or investors would probably still want to buy in Raleigh over Jacksonville. However, the divergence in their performance over the last year suggests that new factors are at play in the Housing Market that homebuyers and investors need to be aware of.

Particularly the military trend. Macon, GA (#6) and El Paso, TX (#10) also have a big military presence and rank among the metros where home prices are still booming. These metros are likely receiving a fiscal tailwind from the big increase in military spending that has occurred over the last year.

Moreover, these metros also benefit from their access to VA Loans, a mortgage product backed by the Department of Veterans Affairs. These VA Loans are available to US Military personnel and allow them to buy houses with a 0% down payment with an interest rate that is lower than conventional mortgages.

The fiscal spending surge, combined with easy access to mortgage debt for military personnel, is providing a tailwind to home prices in these metros.

But affordability is the real demand driver. Home Prices are still cheap in these Cities.

But the real reason that these booming housing markets are still holding up is affordability. If you go back to the table above, and focus on the typical Home Value column, you can see that all of these metros have cheap prices.

In particular, all 10 metros have a typical value below the US average ($349,000). And in the case of Topeka, KS and Macon, GA, home prices are nearly 50% below the US average.

To understand this affordability in better detail, let's take a dive into Johnson City, TN, the #7 highest price-growth market. This is a popular retirement destination among transplants due to its slower pace of life in the foothills of East Tennessee.

The typical home price in Johnson City registers $245k, with nicer homes appearing on the market in the range of $300-400k, like the one below, a recently renovated 4 bed, 2 bath at 2,160 square feet.

It's on the market for $335,000 and would cost a homebuyer using a mortgage at today's rates less than $2,000 in terms of their monthly payment.

Now - is this house overpriced? Probably. Could the value of this home in Johnson City decline by 10-15% over the next couple years. Yes it could. However, in a US Housing Market where people are stretched for affordability, a house like this presents a compelling option for buyers. Especially considering the monthly cost of owning it ($1,999) is below the Zillow estimated rental rate ($2,199).

And this relative affordability is ultimately why home prices in Johnson City, as well as the other metros on this list, are still booming.

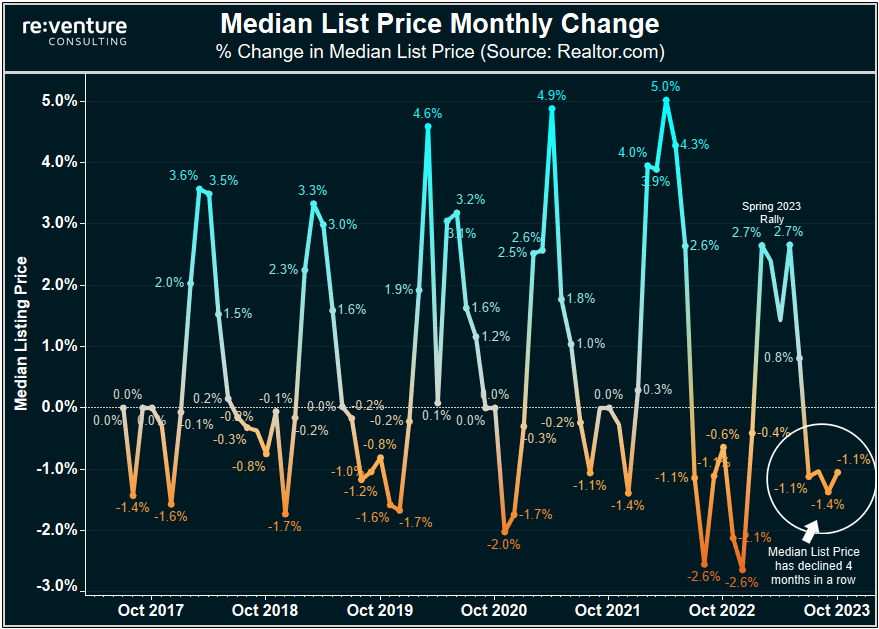

Will Home Prices keep going up in these Cities?

Which leads us to an interesting question, which I'm sure is on your mind if you're a homebuyer or investor: will home prices continue to outperform in these markets going forward?

Well, I have two different answers to that question. One is relative and one is absolute.

In a relative sense - I do think these metros will continue to outperform the US Housing Market as a whole given that they structurally have an advantage in a higher mortgage rate environment due to their affordability. Moreover, the military towns, state capitals (Topka), and college towns (Columbia, Savannah) also have a built-in downside protection against a recession due to a more stable employment base.

However, in an absolute sense, I wouldn't be surprised if home prices begin to fall in some of these markets as the second half of 2023 progresses. Particularly in areas where inventory has increased significantly over the last year.

Like in Jacksonville, NC, where inventory is up 44% YoY. Or Tyler, TX, where inventory is up 62%. Or El Paso where it's up 66%.

I also wouldn't be surprised if Johnson City and Kingsport, TN eventually get dragged down by the broader housing downturn that is hitting Western and Central Tennessee.

I'm curious: would you consider buying in any of these Cities?

One thing I'm curious to hear about is you would consider buying in any of these cities as a homebuyer or investor. Does the fact that home prices are still growing at a healthy clip in these markets intrigue you as a buyer? Or does it scare you since it means they could have a correction coming?

Let me know in the comment section below.

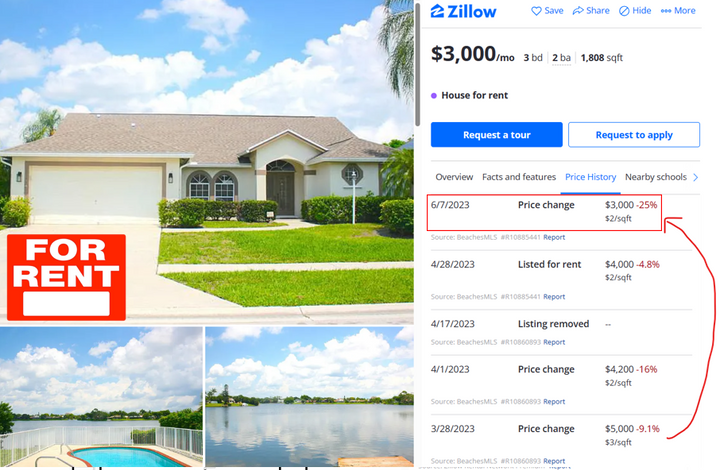

Additionally, get ready for a follow-up post on the Top 10 Cities where Home Prices are Crashing. Price drops in some areas are starting to get fairly substantial.

-Nick

Comments ()